|

|

|

|

|

|

|

|

|

Above offer is subject to relevant terms and conditions. To borrow or not to borrow? Borrow only if you can repay!

Remarks: |

1. |

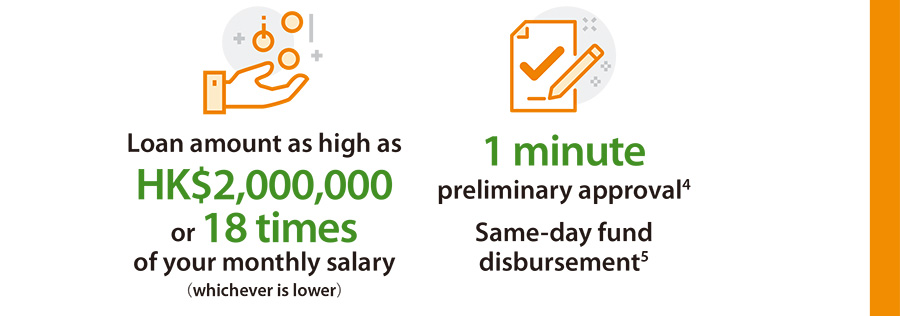

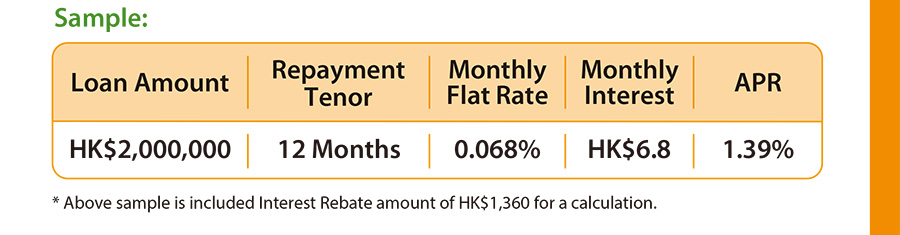

This promotional offer is only applicable for customers successfully apply for and draw down the $mart Plus Tax Season Loan with China CITIC Bank International Limited (the "Bank") during the period from now to 31 March 2023 ("Promotion Period") ("Eligible Customer"). The APR 1.39% is calculated based on loan amount HK$2,000,000, loan tenor of 12 months, monthly flat rate of 0.068%, handle fee waiver and including one month repayment tenor Interest Rebate of HK$1,360. The APR would be 1.51%, excluding Interest Rebate. The APR is calculated in accordance with the practices and methods set out in the relevant guidelines issued by the Hong Kong Association of Banks. An APR is a reference rate which includes the basic interest rate and other applicable fees and charges expressed as an annualized rate. |

||||||||||||||

2. |

During the promotional period, Eligible Customers successfully apply for and draw down the Loan with loan amount of HK$50,000 or above are eligible for Interest Rebate as below: |

||||||||||||||

|

|||||||||||||||

3. |

The amount of interest rebate ("Interest Rebate Amount") is calculated based on the approved loan amount multiplied by the monthly flat rate and no of Interest Rebate Month, and is rounded up to the nearest two decimals places. Interest Rebate Amount will be credited to Eligible Customer's Personal Installment Loan account before the repayment due date of the 7th instalment. Eligible Customers' Loan Account must be valid and in good condition without any late payment or early repayment at the time the Interest Rebate is given, otherwise the Bank reserves the right to cancel the Interest. |

||||||||||||||

4. |

Preliminary approval service only applies to Monday to Friday from 9:00 am to 11:45 pm, Saturday from 9:00 am to 9:45 pm, Sunday and public holidays from 12:00 noon to 8:45 pm. For loan applications that meet relevant approval requirements, applicants will be informed on the preliminary approval result as soon as 1 minute. The processing of loan application starts when all the required information is successfully input into the Bank's system, while the actual processing time required may vary for each individual case. Please note

that the preliminary approval result is for reference only, and the Bank reserves the right to decide (in its sole and absolute discretion) whether to decline or approve any application for a Loan. |

||||||||||||||

5. |

Same-day fund disbursement service only applies to our Bank's service hours (Monday to Friday from 9:00 am to 8:00 pm and except Saturday, Sunday and public holidays). The processing time starts when the approved loan is confirmed with the Bank. For fund disbursement for non-CNCBI bank account, settlement will depend on the handling of receiving financial institution. |

||||||||||||||

6. |

Please note that it do not appoint any third parties to refer applications to the Bank and will not process any application that was referred by a third party. |

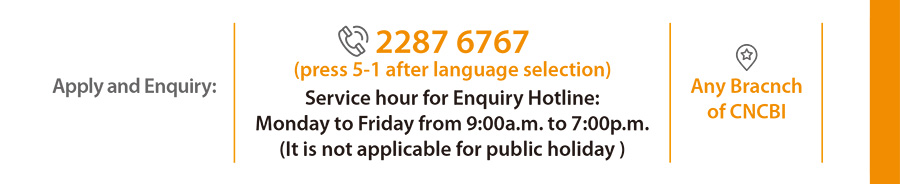

If you do not wish to receive any marketing or promotional materials from the Bank in the future, you may at any time make the request without charge by calling (852) 2287 6767 or using the form at https://www.cncbinternational.com/contact-us/en/. The Bank's staff will call you to confirm the arrangement if you submit such request online. |