Hyperlinks from this Site to websites outside China CITIC Bank International

These hyperlinks will bring to you to another website on the Internet, which is published and operated by a third party which is not owned, controlled or affiliated with or in any way related to China CITIC Bank International Limited (the "Bank"). The hyperlink is provided for your convenience and presented for information purposes only. The provision of the hyperlink does not constitute endorsement, recommendation, approval, warranty or representation, express or implied, by the Bank of any third party or the hypertext link, product, service or information contained or available therein. The Bank does not have any control (editorial or otherwise) over the linked third party website and is not in any way responsible for the contents available therein. You use or follow this link at your own risk. To the extent permissible by law, the Bank shall not be responsible for any damage or losses incurred or suffered by you arising out of or in connection with your use of the link. Please be mindful that when you click on the link and open a new window in your browser, you will be subject to the terms of use and privacy policies of the third party website that you are going to visit.

China CITIC Bank International (CNCBI), working in synergy with parent China CITIC Bank,

providing clients with speedy convenient cross-boundary wealth management services to help them seize the wealth of opportunities in the Greater Bay Area.

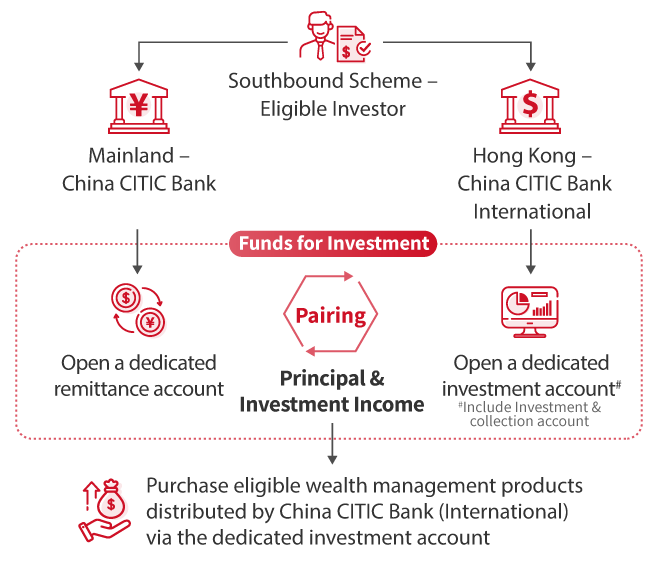

Refers to eligible residents in the Mainland cities in the GBA investing in wealth management products distributed by banks in Hong Kong (“Hong Kong banks”) via designated channels. Banks in the Mainland cities in the GBA (“Mainland banks”) undertake the cross-boundary funds remittance and transfer, and Hong Kong banks undertake the distribution of eligible wealth management products in Hong Kong.

Investment Offers

Invest in the Eligible Investment Products to enjoy the offer, click here to learn more!

Related remittance services are free of charge

From now till 31 December 2026, customers who successfully conduct CNY remittance transaction to beneficiary bank in Mainland China via inMotion can enjoy waiver on relevant remittance service fee*!

| Product | Scope of Investment | Ordering Channel(s) and Minimum Amount |

|---|---|---|

Deposits and Foreign Exchange |

|

Through inMotion or branch |

Funds |

|

Through inMotion: HK$800 or equivalent Through relationship manager: HK$20,000 or equivalent |

Bonds |

|

Through relationship manager: HK$500,000 or equivalent |

Structured Deposits |

#If the deposit is denominated in, linked to or referencing Renminbi, the relevant offshore Renminbi exchange rate will be applied |

Through inMotion or relationship manager: Starts from as low as the equivalent of HKD100,000 |

Southbound Scheme investors should invest in their personal capacity, but not as joint-name or corporate customers, and not authorize a third party to operate the account.

Aged 18 or above

Who are assessed by the Bank as not being a Vulnerable Customer

^ The 9 Greater Bay Area cities within mainland China refer to Guangzhou, Shenzhen, Zhuhai, Foshan, Zhongshan, Dongguan, Huizhou, Jiangmen and Zhaoqing.

You need to open or possess a valid China CITIC Bank's Saving Account (Type I) as a dedicated remittance account. You may open the account by attestation or in person.

You need to visit the designated China CITIC Bank's branches with the account opening documents listed below, and fill-in and sign the application form for opening the China CITIC Bank account and the Bank's Southbound Scheme Account under the witness of designated staff.

China CITIC Bank

Fill out the witnessed account opening form at a CITIC Bank outlet in the GBA

China CITIC Bank (International)

After the review of the account opening documents is completed, the collection account of the dedicated investment account will be opened.

After receiving the mailed notification from the bank, log in to online banking and complete the personal risk assessment

Successfully opened a dedicated southbound investment account

China CITIC Bank

On the CITIC Bank mobile app WMC page, remit RMB funds to your China CITIC Bank (International) account

China CITIC Bank (International)

Conduct transactions from inMotion mobile banking app, including (foreign exchange trading/fund inquiry and order/conduct Fixed Rate Currency Linked Structured Deposit/ time deposit, etc.)+

+ For some products such as bonds and other Structure Deposit, you need to contact your relationship manager to trade

You can choose the following methods to make an appointment:

China CITIC Bank

Fill out the WMC (Southbound Scheme) opening form

China CITIC Bank (International)

the dedicated investment account will be opened.

log in to online

China CITIC Bank

On the CITIC Bank mobile app WMC page, remit RMB funds to your China CITIC Bank (International) account

China CITIC Bank (International)

Conduct transactions from inMotion mobile banking app, including (foreign exchange trading/fund inquiry and order/conduct Fixed Rate Currency Linked Structured Deposit/ time deposit, etc.)+

+ For some products such as bonds and other Structure Deposit, you need to contact your relationship manager to trade

Login is not required, just open the inMotion mobile banking app

Tap the Menu icon on the right hand corner > WMC > go to "Check out fund lists" under the "Southbound Scheme" section

Servicing hour of cross-border toll-free hotline is from Monday to Friday 9am to 6pm; Saturday 9am to 1pm (except public holidays)

Download via App Store

or Google Play

Download via

Baidu App Searcher or

click here to download

Android APK

Remarks: Some hyperlinks allow you to leave China CITIC Bank International Limited website. Please read our Hyperlink Policy.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC. Huawei Services (Hong Kong) Co., Limited. HUAWEI EXPLORE IT ON AppGallery and the HUAWEI EXPLORE IT ON AppGallery logo are the registered trademarks of Huawei Technologies Co., Limited. Baidu App Searcher is a registered trademark of Beijing Baidu Netcom Science Technology Co., Ltd.

Cross-border wealth management hotline (located in the mainland) :

(86-20) 2232 6203 or

400-613-7056 (effective from June 1, 2025)

Important Notice: The previous hotline 400-842-5558 will be discontinued effective July 1, 2025.

Get to know more about the market trend and cross-border service information through our WeChat Official Account by searching and following "cncbintl"

Servicing hour of cross-border toll-free hotline is from Monday to Friday 9am to 6pm; Saturday 9am to 1pm (except public holidays)

Upon completion of account opening, your dedicated remittance account in Mainland China should have been automatically paired with your Multi-currencies Statement Savings Account (Southbound WMC) with our Bank. Customer can simply submit your southbound remittance instruction via CNCB's APP. Southbound remittance is subject to the aggregate quota under the Southbound Scheme, the individual investor quota and relevant remittance transaction limit of CNCB. Under normal circumstances, if the remittance is received from the remitter bank by our Bank before cut-off time (HKT 5:15pm) on any business day, remittance funds will be credited to your Multi-currencies Statement Savings Account (Southbound WMC) on the same day. “Business day” means a day other than Saturday, Sunday and public holidays in Hong Kong.

You may withdraw funds by simply submitting northbound remittance instructions via inMotion: ‘Wealth Management Connect' > ‘Remittance'. Maximum outward remittance amount is subject to the “Remittance for Wealth Management Connect” daily transaction limit. You can adjust your daily transaction limit via i-banking. Remittance instructions submitted before cut-off time (HKT 2:30p.m.) on Monday to Friday (excluding public holidays in Hong Kong and Mainland China) will be processed on the same day. Instructions received after cut-off time will be processed on the next business day of Hong Kong and Mainland China. “Business day” means a day other than Saturday, Sunday and public holidays in both Hong Kong and Mainland China. Under normal circumstances, funds remitted will be credited to your dedicated remittance account in Mainland China on the same day or the next business day in both Hong Kong and Mainland China, depending on the handling of the beneficiary bank.

Yes. Currently, the Bank's individual investor quota for each investor under the Southbound Scheme is RMB 3 million. Individual investor quota is calculated on a net basis. If an investor simultaneously selects both a bank and a licensed corporation for investment under Southbound Scheme, the individual investor quota allocated between the bank and the licensed corporation will each be RMB 1.5 million. The net cumulative remittance from the paired CNCB Saving Account (Type I) to the Multi-currencies Statement Savings Account under the Southbound Scheme by each investor should not, at any time, exceed the individual investor quota. Once the net cumulative remittance to the Multi-currencies Statement Savings Account exceeds the upper limit of the individual investor quota, the Bank will refuse to accept such funds. Besides the individual investor quota, remittances from the Mainland under the Southbound Scheme is subject to an aggregate quota. The aggregate quota is calculated on a net basis. The cumulative net remittance from the Mainland under the Southbound Scheme should not, at any time, exceed the aggregate quota. When the usage of the aggregate quota under the Southbound Scheme reaches its upper limit, Hong Kong banks cannot accept inward remittance from the Mainland and can only proceed with outward remittances back to the Mainland under the Southbound Scheme. The aggregate quota is RMB 150 billion, subject to the latest announcement by the Hong Kong Monetary Authority and the People's Bank of China.

Please refer to the CNCB Mobile App or contact CNCB's hotline at +86 10 84518858 for details.

Remarks:

* Applicable to charge type which is borne by remitter only. Fee waiver on (i) HK$100 Telex/SWIFT handling charge and (ii) Correspondent bank charge. About Bank service fees and charges.

Promotion terms and conditions apply. Promotion period of each offer might vary, for details, please refer to above promotion terms and conditions or contact our branch staff.

Important Notes

Certain investment products are structured products involving financial derivatives. While the investment decision is yours, you should not invest unless the intermediary has explained that the product is suitable for you after considering your financial situation, investment experience, and objectives. Do not make investment decisions based solely on this webpage. Before making any investment decision, you should read and understand the relevant offering documents, familiarize yourself with the product details and associated risks, carefully consider your own financial situation, investment experience, and objectives, and consult independent professional advice if needed.

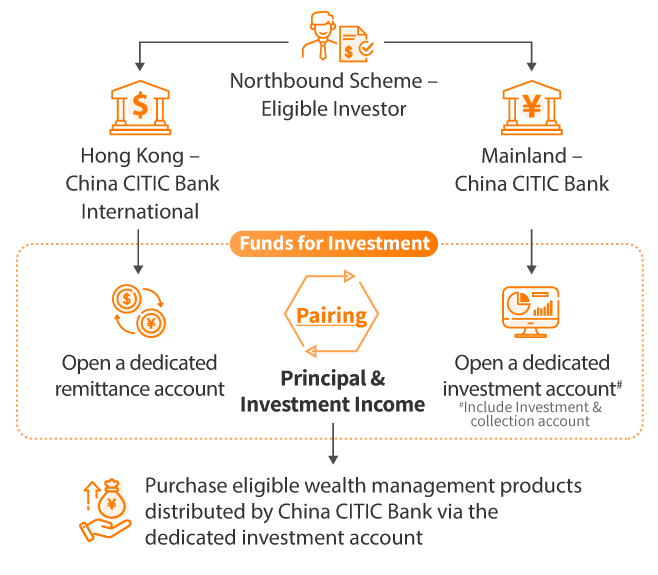

Refers to eligible residents in Hong Kong investing in wealth management products distributed by Mainland banks via designated channels. Hong Kong banks undertake the cross-boundary funds remittance and transfer, and Mainland banks undertake the distribution of eligible wealth management products on the Mainland.

Overview of Wealth

Northbound Scheme investors should invest in their personal capacity, but not as joint-name or corporate customers, and should not authorize a third party to operate the account.

All Hong Kong residents who hold a Hong Kong identity card, including permanent and non-permanent residents

Who are assessed by the Bank as not being a Vulnerable Customer

The customer should possess the Bank's Savings Account

After the customer's eligibility on the Northbound Scheme has been verified, the Bank may open a new Multi-currencies Statement Savings Account - RMB (Northbound WMC) (regardless of whether such investor already has accounts with the Bank).

The Bank will confirm with our Mainland partner bank, China CITIC Bank that it has verified the eligibility of the investor concerned for the Northbound Scheme as well as confirmed the particulars of the investor, such as his/her dedicated remittance account number (The Multi-currencies Statement Savings Account- RMB (Northbound WMC)).

Each eligible investor under the Northbound Scheme should apply to open a dedicated investment account under the Northbound Scheme with the China CITIC Bank. The customer needs to travel to the Mainland to complete the account opening procedures, please refer to the China CITIC Bank's website for details.

Please note that the bank is not the representative or agent of China CITIC Bank in Hong Kong.

Inquiries about Northbound Scheme (in Hong Kong):

(852) 2287 6058

Servicing hour of cross-border toll-free hotline is from Monday to Friday 9am to 6pm; Saturday 9am to 1pm (except public holidays)

The customer should possess the Bank's saving account and visits our branch in person. After the customer's eligibility on the Northbound Scheme has been verified, the Bank may open a new Multicurrencies Statement Savings Account- RMB (Northbound WMC) (regardless of whether such investor already has accounts with the Bank). The Bank will confirm with CNCB that it has verified the eligibility of the investor concerned for the Northbound Scheme as well as confirmed the particulars of the investor, such as his/her dedicated remittance account number (The Multicurrencies Statement Savings Account- RMB (Northbound WMC)). Each eligible investor under the Northbound Scheme should apply to open a dedicated investment account under the Northbound Scheme with the CNCB. The customer needs to travel to the Mainland to complete the account opening procedures, please refer to the CNCB Mobile App or contact CNCB's hotline at +86 10 84518858 for details. Please note that the bank is not the representative or agent of CNCB in Hong Kong.

If the customer already possesses a valid bank account of CNCB in GBA, the customer can designate the existing account via CNCB Mobile App as the dedicated investment account under Northbound Scheme.

RMB-denominated deposit products; public fixed income wealth management products and equity wealth management products, with risk rating of “R1” to “R3” (excluding wealth management products for the purpose of cash management); and public securities investment funds with risk rating “R1” to “R4” (excluding commodity futures funds

For fees and charges regarding the Multi-currencies Statement Savings Account- RMB (Northbound WMC), please refer to the Products Service Fees & Charges for the account related Fees & Charges.

For the bank account and the dedicated investment account of CNCB in GBA, please refer to the CNCB Mobile App or contact CNCB's hotline at +86 10 84518858 for details.

Risk Disclosure specific to Investment Funds

(1) Investment Funds are not equivalent to time deposits or its substitute and provide no guarantee of return or yield on investment. (2) Investors should note that investment involves risk and past performance is not indicative of future performance. The price of the Investment Funds may go down as well as up and may become valueless. It is as likely that losses will be incurred rather than profits made as a result of investing in Investment Funds. In the worst case scenario, the value of the Investment Funds may be substantially less than your investment amount. (3) You should not invest in Investment Funds based on this promotion page alone. Investors should consider their own investment objectives, finanical resources and relevant circumstances,and read the relevant offering document, terms and conditions and risk disclosure statement before making any investment decision. (4) Investors should carefully read the relevant fund's offering documents (including the investment policy and risk factors stated therein) in details before making any investment decision. If needed, investors should seek independent professional advice.

Risk Disclosure Statements in relation to Bonds

(1) Investment involves risk. The prices of bonds can fluctuate, sometimes dramatically. The price of bonds may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling bonds. (2) Investing in this product is not equivalent to time deposit. This product is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong. (3) Default/ Credit risk - There is a risk that the issuer may fail to pay you the interest or principal as scheduled. In the worst case scenario, you may not be able to receive back the interest and principal if the issuer defaults on the bond. (4) Interest rate risk - When the interest rate rises, the price of a fixed rate bond will normally drop. (5) Exchange rate risk - If your bond is denominated in a foreign currency, you may face an exchange rate risk if you choose to convert payments made on bond to your home currency. (6) Liquidity risk - If you need to sell the bonds before maturity for an urgent cash-flow need or use the capital for other investments, you may not be able to do this since the liquidity of the secondary bond market could be low. If you choose to sell your bond before it matures, you may lose part or all of your investment. (7) Reinvestment risk - If you hold a callable bond, when the interest rate goes down, the issuer may redeem the bond before maturity. If this happens and you have to re-invest the proceeds, you may not be able to enjoy the same rates of return. (8) Equity risk - If your bond is "convertible" or "exchangeable", you also face equity risk associated with the stock. A fall in the stock price will usually follow by a fall in the bond price.

Risk Disclosure Statements for Foreign Currency

Foreign currency investments are subject to exchange rate risk which may result in gain or loss. The fluctuation in the exchange rate of foreign currency may result in losses in the event that customer converts the foreign currency into HKD or other foreign currencies. Renminbi is not freely convertible at present. The actual conversion arrangement will depend on the restrictions prevailing at the relevant time.

Risk Disclosure Statements for Structured Deposit

The following risk disclosure statements cannot disclose all the risks involved.

(1) Not a time deposit – This product is NOT equivalent to, nor should it be treated as a substitute for, time deposit. It is NOT a protected deposit and is NOT protected by the Deposit Protection Scheme in Hong Kong.

(2) Principal protection at maturity ONLY – This product is principal protected ONLY IF this product is held to maturity. If this product is early terminated, you may suffer from a substantial loss due to the devaluation of the embedded derivative(s).

(3) Derivatives risk – This product is embedded with a currency swap with Spot Rate and Forward Rate as prescribed in the Product Term Sheet. Generally, when buying this product, you may be subject to market risk, credit risk, liquidity risk, legal risk and settlement risk.

(4) Credit risk of the Bank – This product is not secured by any collateral. When you invest in this product, you will be relying on the Bank's creditworthiness. If the Bank becomes insolvent or defaults on its obligations under this product, you can only claim as an unsecured creditor of the Bank. In the worst case, you could suffer a total loss of your deposit amount.

(5) Maximum potential loss – This product is principal protected at Maturity ONLY. You may lose your entire deposit amount if the Bank defaults in performing its obligations or there has been a tremendous devaluation of the Settlement Currency you receive at maturity.

(6) Limited potential gain – The maximum potential gain is limited to the interest payment to be determined by reference to the Interest Rate.

(7) No secondary market – This product is not a listed security. There is no secondary market for you to sell this product prior to its maturity.

(8) Not the same as buying the Underlying currency – Investing in this product is not the same as buying the Linked Currency directly. Changes in the market price of the Linked Currency may not lead to corresponding changes to the market value and/or the performance of this product.

(9) Liquidity risk – This product is designed to be held till maturity. You do not have a right to request early termination of this product before maturity.

(10) Currency risk – If the Settlement Currency is not your home currency, and you choose to convert it back to your home currency upon maturity, you may make a gain or loss due to exchange rate fluctuations.

(11) Risks relating to Renminbi – Where the Settlement Currency is in Renminbi, you should note that the value of Renminbi against other foreign currencies fluctuates and will be affected by, amongst other things, the PRC government's control (for example, the PRC government regulates conversion between Renminbi and foreign currencies), which may adversely affect your return under this product when you convert Renminbi into your home currency. Renminbi is not freely convertible at present. The actual conversion arrangement will depend on the restrictions prevailing at the relevant time.

This material does not itself constitute any offer of or invitation to any person to purchase or sell or acquire or invest in any investment products. You should not only base on this material alone to make investment decisions.

China CITIC Bank International Limited is an authorized institution under the Banking Ordinance and is regulated by the Hong Kong Monetary Authority.

This material has not been reviewed by the Securities and Futures Commission of Hong Kong or any regulatory authority in Hong Kong.