Header navigation:

Online Security and Privacy |

||||||||||||||

Customers should read the Bank's Online Security and Privacy for Online Security from time to time to ensure that adequate and appropriate measures have been taken. |

||||||||||||||

|

||||||||||||||

|

||||||||||||||

| Stay alert to Phishing Communications | ||||||||||||||

Phishing is a cybercrime that fraudsters try to lure you into providing sensitive data such as personal information, bank account / credit card details, and login credentials, etc. The common way to do so is asking you to click on a hyperlink, scan a QR code, or open an attachment embedded in email, SMS or instant message, and the fraudsters can use the information provided by you to access your bank accounts and conduct unauthorized transactions.

|

||||||||||||||

| What you could do to protect yourself? | ||||||||||||||

|

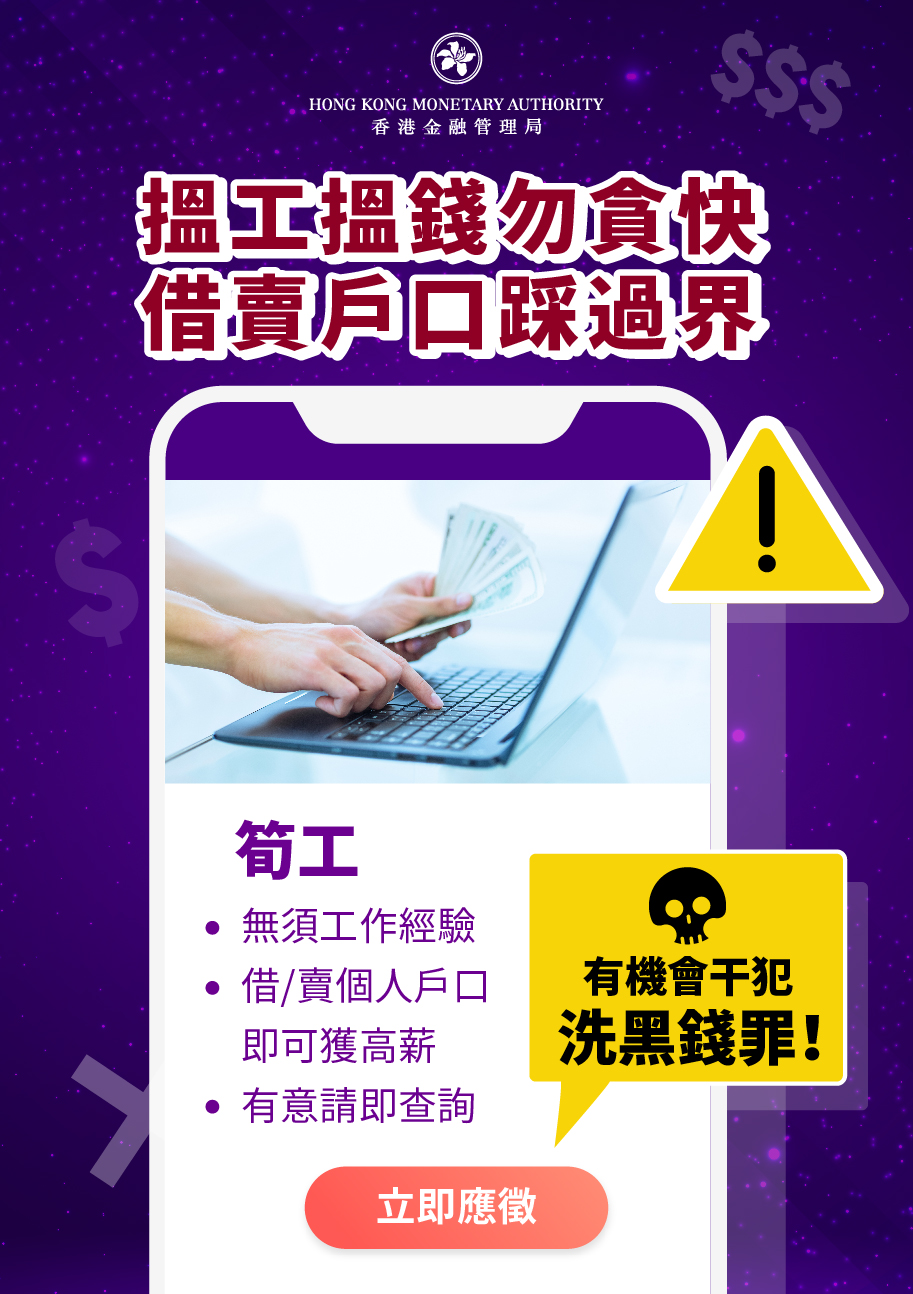

| Advice from HKMA “Don't Lend/Sell Your Account” | ||

Please refer to the website for details. | ||

|

||

|

||

| Be cautious of Stooge Account | ||

A stooge account is either set up with false paperwork using a stolen or manipulated identity, or belongs to a legitimate customer who has allowed criminals to use their account. Criminals often target vulnerable people, i.e. those financially struggling, by tempting them with cash to permit access to their accounts. |

||

| What you could do to protect yourself? | ||

|

| Be cautious of AI fraud | ||||||||||||||||||||||||||

With the continuous advancement of artificial intelligence (AI) technology, criminals can construct more realistic situations and design more complex scams when using these technologies to impersonate others. The following are several common scam using AI technology |

||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

What you could do to protect yourself? |

||||||||||||||||||||||||||

If the following situations are discovered, it may be necessary to further confirm the authenticity to prevent artificial intelligence scams:

|

||||||||||||||||||||||||||

| Be cautious of Malware (trojan horses, spyware etc.) | ||||||||||||||||||||||||||

Trojan Horse Program could capture your PC screen, logging keystrokes history or at the runtime, and remote control your computer or mobile devices (smartphones or tablets) (thereafter collectively as “Devices”). It steals information like your Login ID, passwords, SMS OTP or other personal data to proceed fraudulent or unauthorized transactions with your bank accounts. If you found any unusual circumstance when using the Bank’s Internet banking services, please immediately contact us and should also stop inputting any password or transaction. |

||||||||||||||||||||||||||

Spyware is a malicious program that is installed on the Devices without user's acknowledgement or consent, with a threat to information leakage. This program often comes from the hidden components of "free program". |

||||||||||||||||||||||||||

To further protect your e-banking security, access to inMotion, Business inMotion, inVest, and FX Go and CNCBI Token would be suspended if potential risks had been detected on your device. |

||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

If your access to mobile banking applications is suspended, you should: |

||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

In addition, Android device users will also use the secure keyboard provided by the Bank when entering their passwords on mobile banking applications. For more information, please refer to the press release from the Hong Kong Association of Banks “Enhancement on security measures to safeguard customers against malware scams”: https://www.hkab.org.hk/en/news/press-release/292 |

||||||||||||||||||||||||||

| What you could do to protect yourself? | ||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

| Verify the genuineness of the website | ||||||||||

There are some fraudulent websites or mobile application created by Internet fraudsters that mimics the look of a particular bank's website to capture your login credentials and / or sensitive personal information such as Login ID, passwords, other personal information or transaction details etc. Some of them will attract people to their sites through scam emails. Therefore, it is crucial to make sure that you are connecting with a genuine website of the Bank. |

||||||||||

| What you could do to protect yourself? | ||||||||||

|

| Be cautious of bogus phone calls, voice messages, SMS / instant messages and emails | ||||||||||||||

Please take note that the Bank observes a well-adopted practice of not seeking sensitive personal information (including i-banking login ID, login passwords or one-time passwords) through phone calls, voice messages, SMS/instant messages or emails. Fraudsters may make bogus phone calls, voice messages, SMS/instant messages and emails purported to be from the Bank in which most of them appear to come from a lawful source. Such communications may trick recipients, including citing irregularities regarding the customer’s transactions or accounts, to reveal their personal information such as login ID, passwords, credit card numbers, bank account numbers, one-time passwords, etc., or even inviting them to visit fraudulent website, call a bogus bank hotline number or contact an operator for account authentication requesting for provision of such information. They may also pose as invitations to group chats about investment and/or banking products, or requests for third-party software downloads or fund transfers. |

||||||||||||||

| What you could do to protect yourself? | ||||||||||||||

|

| Security Measures Imposed by the Bank | ||||||||||||||||||||||||||||||||||||||||||||

We employ one of the highest levels of security to protect customer's accounts and personal data. |

||||||||||||||||||||||||||||||||||||||||||||

| Here are some of the safeguards we've put in place: | ||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||

| Security Measures Recommended to Customers, and risks disclosure | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

To ensure highest security while using the Bank’s Internet banking services, customers are recommended to take a number of safeguard measures for their own protection. At the same time, customer should be acknowledged about the risks associated with authentication factors such as biometric authentication and device binding.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What you could do to protect yourself? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Be served by our professional staff at our branches, or opt for self-service banking via our automated channels — the choice is yours.

Careers

We offer a range of rewarding careers from trainee to management level.

Tap into the vast resources and network of our parent bank China CITIC Bank and our ultimate shareholder, CITIC Group Corporation.