Header navigation:

4Q2019

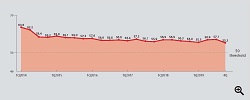

The 4Q2019 CNCBI Cross-border Banking Demand Index stands at a record low of 55.3 since the launch of the index, logging the second biggest quarter-on-quarter decline of 1.8, underscoring the brunt of the escalating China-US trade war on the mainland’s demand for Hong Kong’s cross-border banking services.

The Corporate Demand Index falls 0.9 to 54.3 on the quarter, indicating a marked decline of mainland corporations’ “going out” aspiration after the escalation of the China-US trade war at August’s dawn. Meanwhile, the Individuals Demand Index breaks the 60 mark for the first time with a sharp fall of 5.1 to 59.5, implying that mainland individuals’ “going out” aspiration is dampened even more significantly by the double blow of the trade war escalation.

In 4Q2019, the expectation of regulatory looseness sub-index falls 0.5 on the corporate side while a 2.7 plunge is seen in individuals to respectively 48.1 and 47.7.

Be served by our professional staff at our branches, or opt for self-service banking via our automated channels — the choice is yours.

Useful Links

Careers

We offer a range of rewarding careers from trainee to management level.

Tap into the vast resources and network of our parent bank China CITIC Bank and our ultimate shareholder, CITIC Group Corporation.