For customers located in China, please download the inMotion APK.

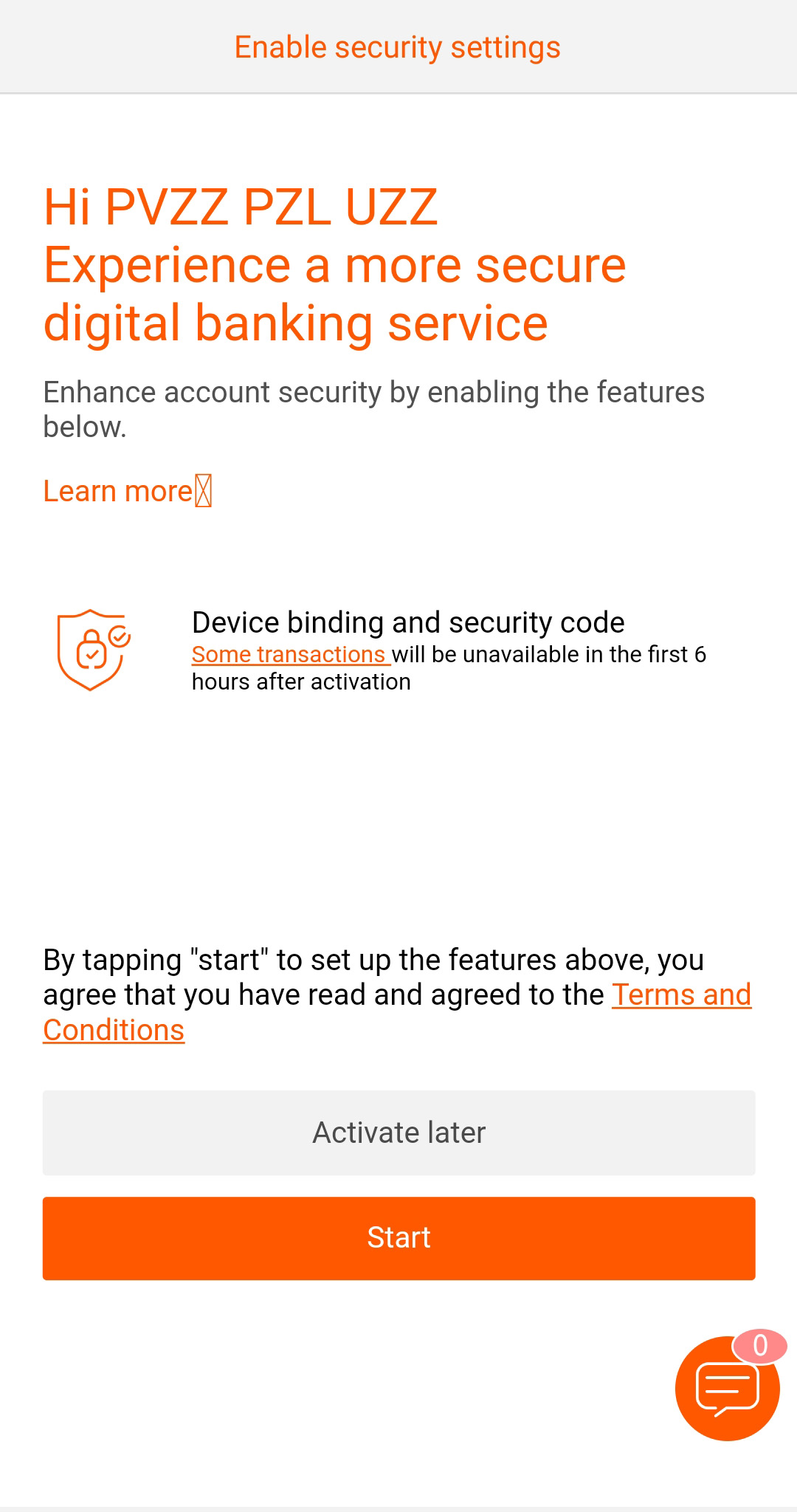

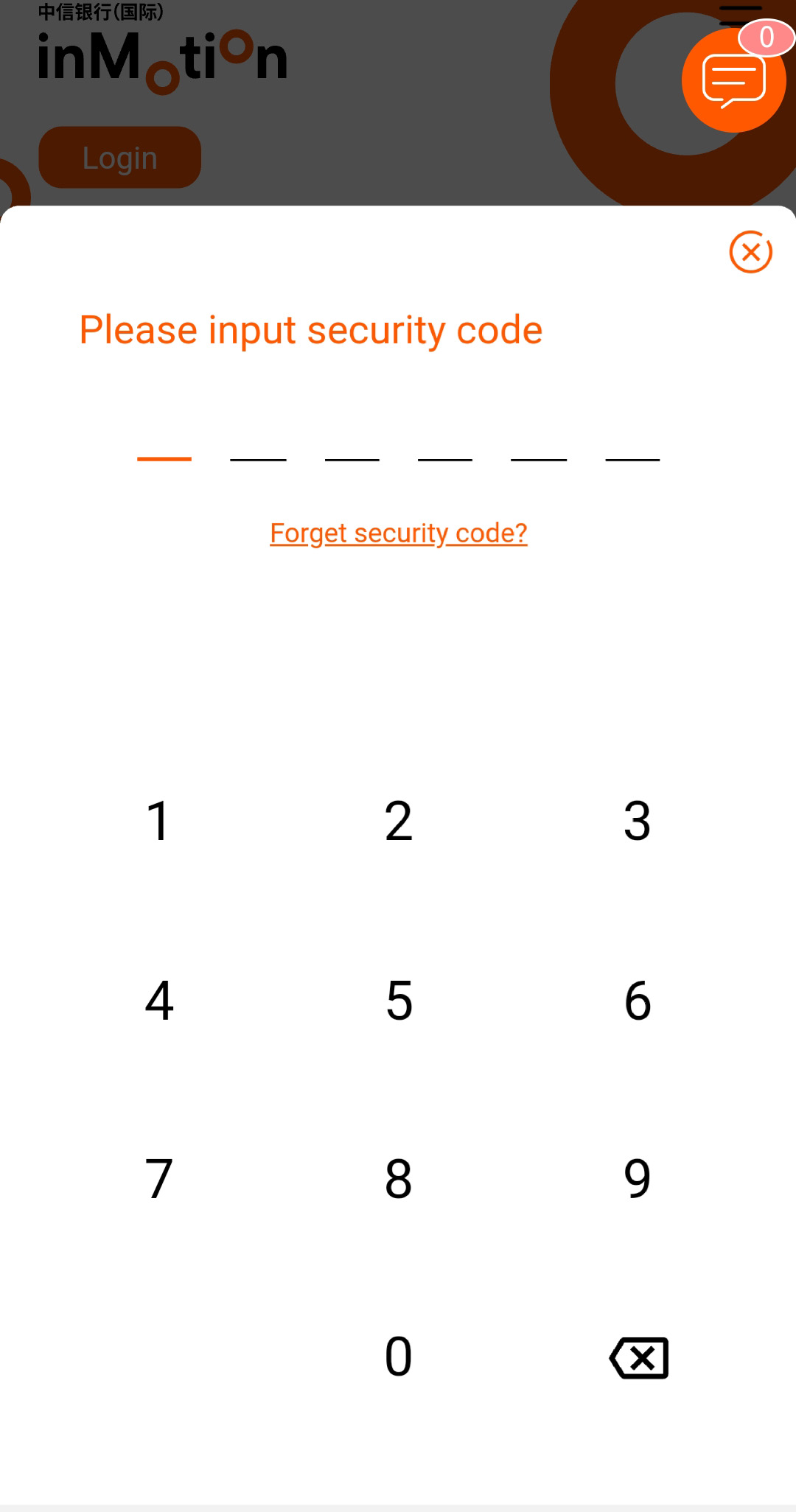

You can also perform the setup via inMotion’s “Security Center” after logging in.

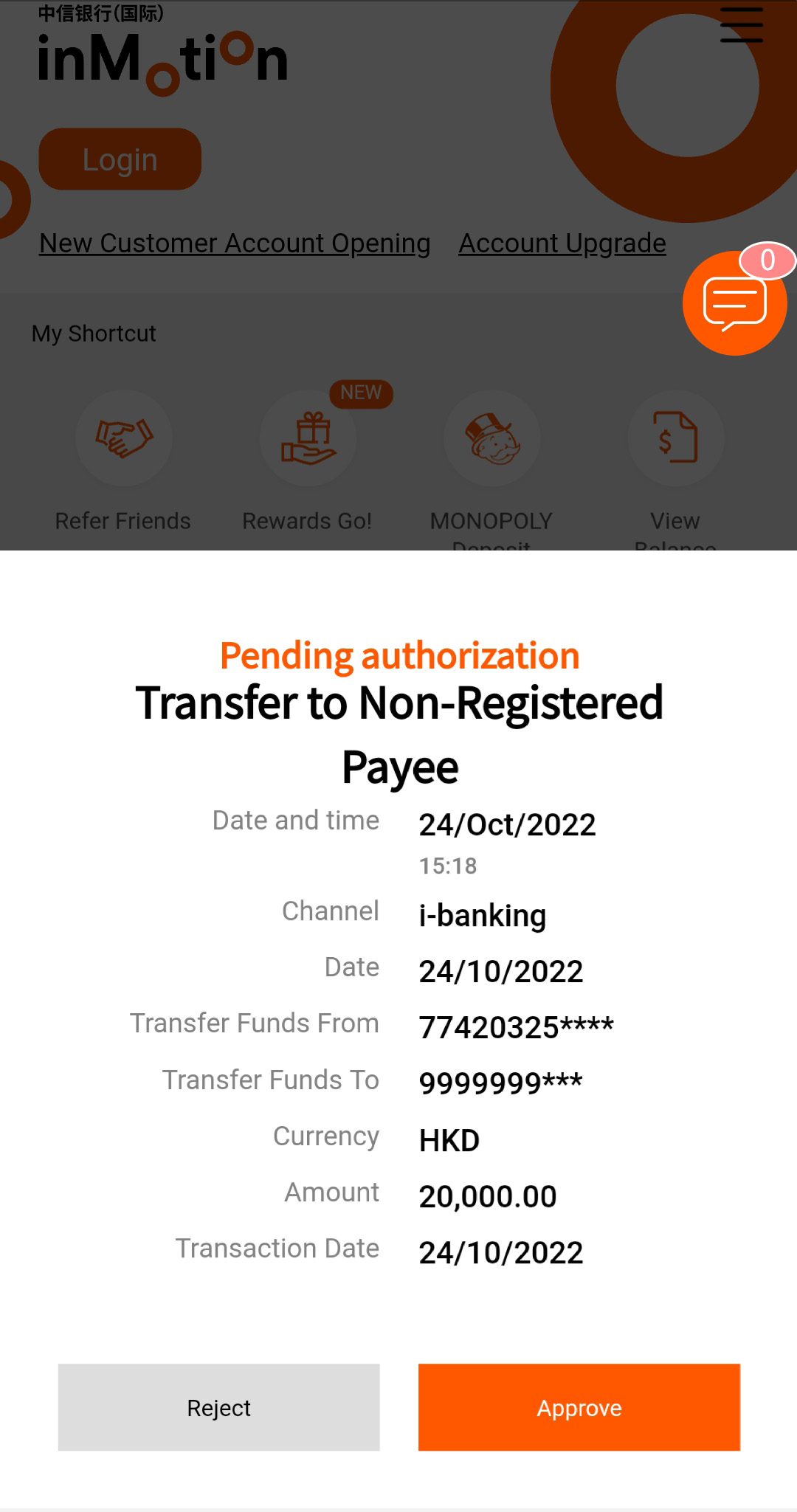

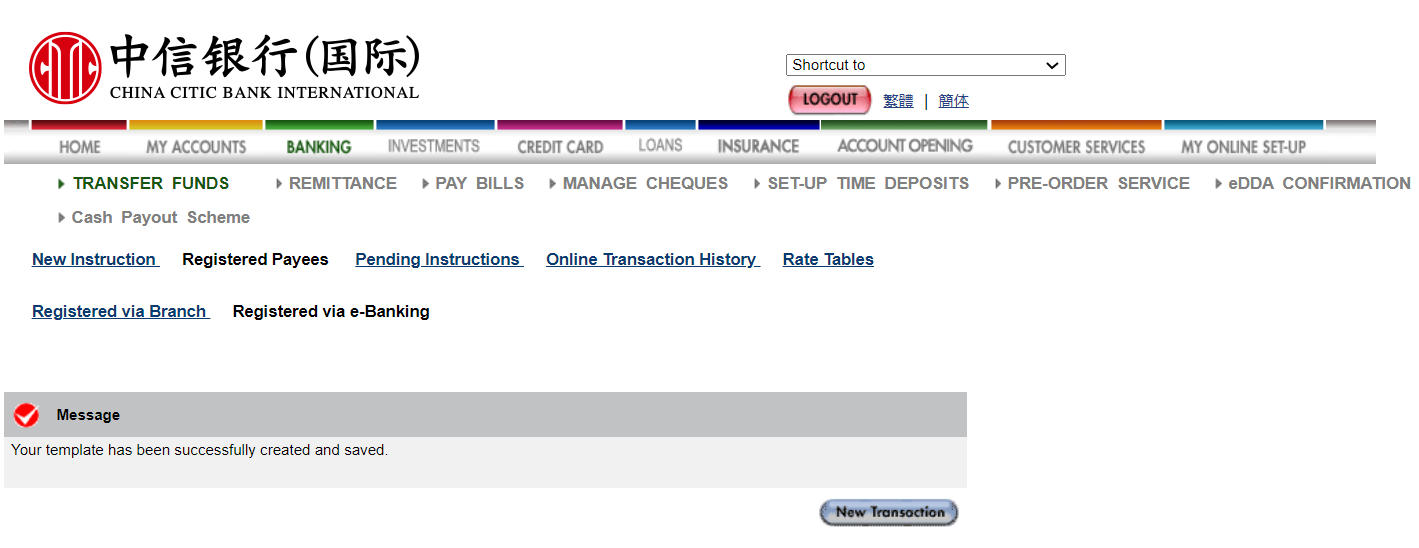

After successful activation, you can perform identity authentication seamlessly on inMotion or inVest (Security Code is only required for certain high-risk transactions). To safeguard your account, certain high-risk payment transactions and change of personal information will not be available in the first 6 hours after setting up Security Code.

Your phone will also receive push notification during authentication

Applicable to certain high-risk transactions only

Please refer to the “Security” section under inMotion FAQ.

Remarks: Some hyperlinks allow you to leave China CITIC Bank International Limited website. Please read our Hyperlink Policy.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC. Huawei Services (Hong Kong) Co., Limited. HUAWEI EXPLORE IT ON AppGallery and the HUAWEI EXPLORE IT ON AppGallery logo are the registered trademarks of Huawei Technologies Co., Limited.

Hyperlinks from this Site to websites outside China CITIC Bank International

These hyperlinks will bring to you to another website on the Internet, which is published and operated by a third party which is not owned, controlled or affiliated with or in any way related to China CITIC Bank International Limited (the "Bank"). The hyperlink is provided for your convenience and presented for information purposes only. The provision of the hyperlink does not constitute endorsement, recommendation, approval, warranty or representation, express or implied, by the Bank of any third party or the hypertext link, product, service or information contained or available therein. The Bank does not have any control (editorial or otherwise) over the linked third party website and is not in any way responsible for the contents available therein. You use or follow this link at your own risk. To the extent permissible by law, the Bank shall not be responsible for any damage or losses incurred or suffered by you arising out of or in connection with your use of the link. Please be mindful that when you click on the link and open a new window in your browser, you will be subject to the terms of use and privacy policies of the third party website that you are going to visit.