Hyperlinks from this Site to websites outside China CITIC Bank International

These hyperlinks will bring to you to another website on the Internet, which is published and operated by a third party which is not owned, controlled or affiliated with or in any way related to China CITIC Bank International Limited (the "Bank"). The hyperlink is provided for your convenience and presented for information purposes only. The provision of the hyperlink does not constitute endorsement, recommendation, approval, warranty or representation, express or implied, by the Bank of any third party or the hypertext link, product, service or information contained or available therein. The Bank does not have any control (editorial or otherwise) over the linked third party website and is not in any way responsible for the contents available therein. You use or follow this link at your own risk. To the extent permissible by law, the Bank shall not be responsible for any damage or losses incurred or suffered by you arising out of or in connection with your use of the link. Please be mindful that when you click on the link and open a new window in your browser, you will be subject to the terms of use and privacy policies of the third party website that you are going to visit.

Structured Deposit is a structured product involving derivatives. The investment decision is yours but you should not invest in the Deposit unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. Investment involves risks. You should not invest in this product based on this webpage alone. Before making any investment decision, you should read and understand the relevant offering documents for further details and the risks involved and carefully consider your financial situation, investment experience and investment objectives. You should seek independent professional advice if needed.

This product is NOT equivalent to, nor should it be treated as a substitute for, time deposit. It is NOT a protected deposit and is NOT protected by the Deposit Protection Scheme in Hong Kong.

You can get back 100% of your capital at maturity, regardless of how your chosen foreign currency performs.

You will receive the principal and interest on date of Maturity, it could help you earn potentially higher returns than a time deposit1.

There are no fees or charges when placing the Deposit.

You can enjoy more flexibility with term lengths spanning 1 to 12 months to match your investment goals and needs.

You can choose various major foreign currencies include: HKD, USD, AUD or other currency as agreed by the Bank.

Withdrawal in the same currency as the deposit currency at maturity.

Starts from as low as the equivalent of HKD100,000

Easily subscribe via inMotion or visit any branch in person

HKD, CNY2, USD, AUD, NZD, GBP, EUR, CAD, CHF

inMotion : Trading hours are from 10:00 am (Hong Kong time) to 4:00 pm (Hong Kong time) (Mondays to Fridays, excluding public holidays).

Branch : Trading hours are from 9:00 am (Hong Kong time) to 5:00 pm (Hong Kong time) (Mondays to Fridays, excluding public holidays)3.

Take a look at our illustrative example to see what might be involved when placing a Fixed Rate Currency Linked Structured Deposit.

The following demonstration examples and situation analysis are based on hypothetical information for illustration and are not based on the past performance of foreign exchange. They are for reference only and are not any guarantee or indication of structured investment returns. You should not use them to predict the actual performance of the underlying currency or this product, nor should you rely on such examples to make investment decisions.

Deposit Currency

Deposit Amount

Settlement Currency

Linked Currency

Interest Rate (p.a.)

Tenor

For detailed product terms, information and risks, please refer to the product offering documents, or visit any of our branches for details.

The above photos, details and reference interest rate are for reference only.

Starts from as low as the equivalent of HKD2,000,000.

Visit any branch or

22876788 for more information

HKD: HKD-HIBOR-HKAB-Bloomberg

USD: USD-SOFR CME Term

AUD: AUD-BBR-BBSW-Bloomberg

Trading hours are from 9:00 am (Hong Kong time) to 5:00 pm (Hong Kong time) (Mondays to Fridays, excluding public holidays)3.

Take a look at our illustrative example to see what might be involved when placing an Fixed Rate Currency Linked Structured Deposit.

The following demonstration examples and situation analysis are based on hypothetical information for illustration and are not based on the past performance of reference index. They are for reference only and are not any guarantee or indication of structured investment returns. You should not use them to predict the actual performance of the reference index or this product, nor should you rely on such examples to make investment decisions.

Deposit Currency

Deposit Amount

Settlement Currency

Tenor

Base Rate

Factor

Cap (Maximum Interest Rate payable)

Floor (Minimum Interest Rate payable)

Reference Index

Reset Date

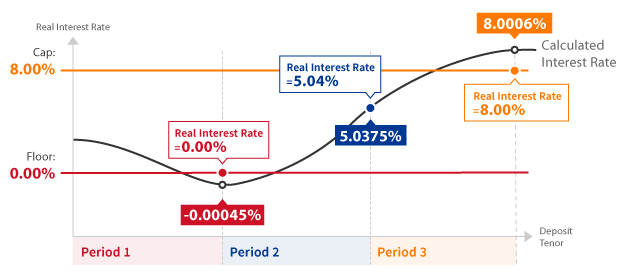

Calculated Interest Rate = Base Rate + Factor x Reference Index

| Calculated Interest Rate ≤ Floor | Floor < Calculated Interest Rate < Cap | Calculated Interest Rate ≥ Cap | |

|---|---|---|---|

| Real Interest Rate | Floor (Minimum Interest Rate payable) | Base Rate + Factor x Reference Index | Cap (Maximum Interest Rate payable) |

The total settlement amount is calculated based on the sum of the deposit amount and the interest amount of each period, and will be paid to the customer on the maturity date.

USD10,000,000(Deposit Amount) + 0 (Interest received in Period 1) + USD126,000 (Interest Received in Period 2) + USD200,000 (Interest Received in Period 3) = USD10,326,000

Best Case Scenario: The reference index is significantly positive, resulting in the Calculated Interest Rate being at or above the Cap for the entire period.

Total settlement amount received at Maturity: USD10,000,000 (Deposit Amount) + USD600,000 (Interest received during Period 1, 2 and 3) = USD10,600,000

Worst Case Scenario: The reference index is significantly negative, resulting in the Calculated Interest Rate being at or below the Floor for the entire period.

Total settlement amount received at Maturity: USD10,000,000 (Deposit Amount) + 0 (Interest received during Period 1, 2 and 3) = USD10,000,000

The Bank becomes insolvent or defaults on its obligations

Assuming that the Bank becomes insolvent during the tenor of this product or defaults on its obligations under this product, you can only claim as its unsecured creditor. In the worst case scenario, you may receive nothing and suffer a total loss of your deposit amount.

For detailed product terms, information and risks, please refer to the product offering documents, or visit any of our branches for details.

Remarks:

1. Structured Deposit is NOT equivalent to, nor should it be treated as a substitute for, time deposit. The maximum potential gain is limited to the interest payment.

2. If the deposit is denominated in, linked to or referencing Renminbi, the relevant offshore Renminbi exchange rate will be applied.

3. The closing date and time for the application will be prescribed in the Product Term Sheet and may be subject to change at the discretion of the Bank.

Risk Disclosure Statements for Structured Deposit

The following risk disclosure statements cannot disclose all the risks involved.

(1) Not a time deposit – This product is NOT equivalent to, nor should it be treated as a substitute for, time deposit. It is NOT a protected deposit and is NOT protected by the Deposit Protection Scheme in Hong Kong.

(2) Principal protection at maturity ONLY – This product is principal protected ONLY IF this product is held to maturity. If this product is early terminated, you may suffer from a substantial loss due to the devaluation of the embedded derivative(s).

(3) Derivatives risk – This product is embedded with a currency swap with Spot Rate and Forward Rate as prescribed in the Product Term Sheet. Generally, when buying this product, you may be subject to market risk, credit risk, liquidity risk, legal risk and settlement risk.

(4) Credit risk of the Bank – This product is not secured by any collateral. When you invest in this product, you will be relying on the Bank's creditworthiness. If the Bank becomes insolvent or defaults on its obligations under this product, you can only claim as an unsecured creditor of the Bank. In the worst case, you could suffer a total loss of your deposit amount.

(5) Maximum potential loss – This product is principal protected at Maturity ONLY. You may lose your entire deposit amount if the Bank defaults in performing its obligations or there has been a tremendous devaluation of the Settlement Currency you receive at maturity.

(6) Limited potential gain – The maximum potential gain is limited to the interest payment to be determined by reference to the Interest Rate.

(7) No secondary market – This product is not a listed security. There is no secondary market for you to sell this product prior to its maturity.

(8) Not the same as buying the Underlying currency – Investing in this product is not the same as buying the Linked Currency directly. Changes in the market price of the Linked Currency may not lead to corresponding changes to the market value and/or the performance of this product.

(9) Liquidity risk – This product is designed to be held till maturity. You do not have a right to request early termination of this product before maturity.

(10) Currency risk – If the Settlement Currency is not your home currency, and you choose to convert it back to your home currency upon maturity, you may make a gain or loss due to exchange rate fluctuations.

(11) Risks relating to Renminbi – Where the Settlement Currency is in Renminbi, you should note that the value of Renminbi against other foreign currencies fluctuates and will be affected by, amongst other things, the PRC government's control (for example, the PRC government regulates conversion between Renminbi and foreign currencies), which may adversely affect your return under this product when you convert Renminbi into your home currency. Renminbi is not freely convertible at present. The actual conversion arrangement will depend on the restrictions prevailing at the relevant time.

This material does not itself constitute any offer of or invitation to any person to purchase or sell or acquire or invest in any investment products. You should not only base on this material alone to make investment decisions.

China CITIC Bank International Limited is an authorized institution under the Banking Ordinance and is regulated by the Hong Kong Monetary Authority.

This material has not been reviewed by the Securities and Futures Commission of Hong Kong or any regulatory authority in Hong Kong.