Download inMotion

|

|

Download via App Store |

Download via |

Remarks: Some hyperlinks allow you to leave China CITIC Bank International Limited website. Please read our Hyperlink Policy.

New Customers Open

Account In 3 Easy Steps

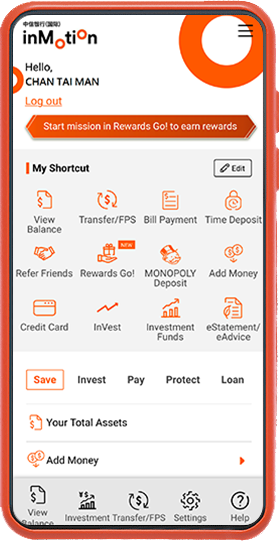

Download

inMotion

Scan ID card and take a selfie for identity verification

Complete and confirm your details. You’re done!

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC. Huawei Services (Hong Kong) Co., Limited. HUAWEI EXPLORE IT ON AppGallery and the HUAWEI EXPLORE IT ON AppGallery logo are the registered trademarks of Huawei Technologies Co., Limited. Baidu App Searcher is a registered trademark of Beijing Baidu Netcom Science Technology Co., Ltd.

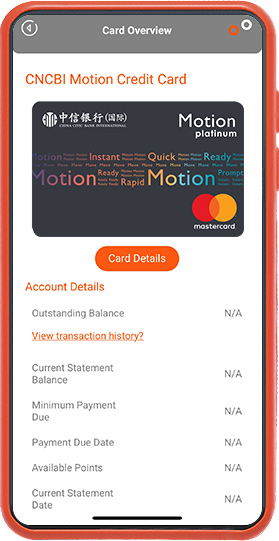

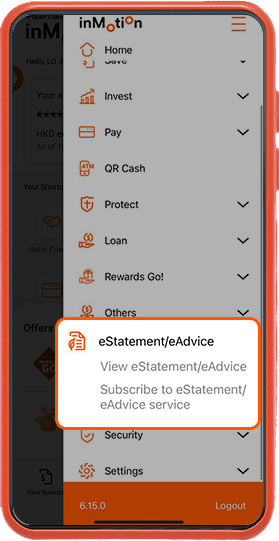

on the upper right corner and select "eStatement/eAdvice“ to check the eStatement/eAdvice details

on the upper right corner and select "eStatement/eAdvice“ to check the eStatement/eAdvice details