Winter Thankful Super Draw

Winter Thankful Super DrawEmbrace our fabulous daily rewards of

Up to HK$2,400 Dining e-Gift voucher

Winter Thankful Super Draw

Winter Thankful Super Draw

CNCBI is delighted to bring you “inMotion Winter Thankful Super Draw” from 1 November 2023 to 31 January 2024.

With our monthly surprises, you will have chances to earn fabulous daily prizes –

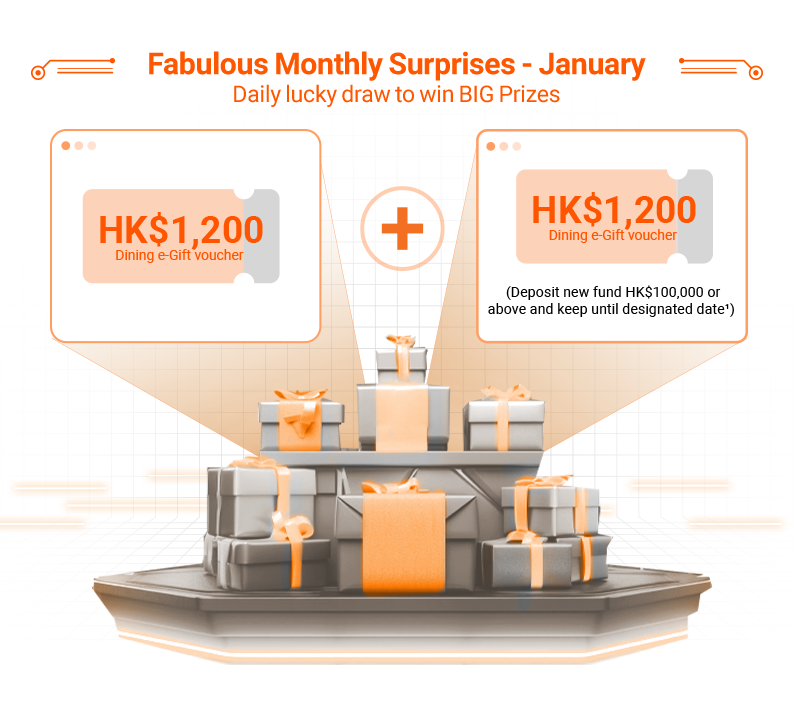

Prize in January: Up to $2,400 Dining e-Gift voucher for you to celebrate special occasions with your loved ones.

Simply register “inMotion Winter Thankful Super Draw” once in "Reward Go!" during the promotion period, and complete designated banking activities via inMotion to accumulate your daily lucky draw chances automatically.

customers will be multiplied by

customers will be multiplied by  !

! and

and  customers will be multiplied by

customers will be multiplied by  !

!

| Designated Activities | Lucky Draw Chance(s) | |

|---|---|---|

|

New customer who opens Multi-Currencies Statement Savings Account via inMotion | 10 chances |

|

Open Investment One Account | 10 chances |

|

Apply for designated credit card(s) with card approval2 | 10 chances / approved card |

|

Apply for designated personal loan(s)3 and draw loan | 10 chances / approved loan |

| Designated Activities | Lucky Draw Chance(s) | |

|---|---|---|

|

Complete “Rewards Go!” mission(s) | 1 chance / mission |

|

Turn on “Receive Marketing Push Notification” | 5 chances |

|

Register CNCBI as FPS default receiving bank | 5 chances |

|

Pay merchant bill(s) | 5 chances / transaction |

|

Upgrade to CITICfirst or CITICdiamond | 10 / upgrade |

| Designated Activities | Lucky Draw Chance(s) | |

|---|---|---|

|

Register for “MONOPOLY Deposit” and/or “MONOPOLY Deposit Top-up Offer” and deposit eligible new fund4 of HK$10,000 or above | 10 chances / registration and fund-in |

|

Register for “PAYROLLplus“ and use PAYROLLplus account for automated payroll payment of HK$12,000 or above from the registration month of PAYROLLplus | 10 chances / registration and fund-in |

|

Set-up Time Deposits | 10 chances / transaction |

| Designated Activities | Lucky Draw Chance(s) | |

|---|---|---|

|

Complete FX transaction | 10 chances / transaction |

|

Trade Hong Kong stocks, U.S. stocks and China A-share5 | 10 chances / transaction |

|

Complete “Investor Risk Analysis” or renewal | 10 chances |

|

Subscribe Currency Linked Deposit | 10 chances / transaction |

|

Subscribe Investment Funds | 10 chances / transaction |

Reminder: To borrow or not to borrow? Borrow only if you can repay!

Important Note

Some of the investment products are structured products involving derivatives. The investment decision is yours but you should not invest in the product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. You should not invest in this product based on this website alone.