Equity Linked Product(s) are complex products embedded with derivatives. The investment decision is yours but you should not invest in the product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. You should not invest in this product based on this material alone.

Equity Linked Products provide no guarantee of return or yield on investment. They are NOT principal protected and investors could lose all of your investment. Please refer to the risk disclosure statements and offering documents for further details. Before making any investment decision, you should read and understand the relevant offering documents for details and the risks involved and carefully consider your financial situation, investment experience and investment objectives. You should seek independent professional advice if needed.

Equity Linked Investments (ELI) are unlisted structured investment products which involves derivatives and the investment returns are linked to the performance of the underlying stock. Some issuers include one or more additional special features in their ELIs. These features may affect the potential gain or loss of the ELIs in different ways.

Depending on your financial goals, you can develop your own personalized investment portfolio and earn higher potential investment returns by selecting number of underlying stocks, appropriate investment tenor, strike price and airbag price etc.

We provide three types of ELI to satisfy different investment targets.

|

Callable Feature

What is Callable Feature ? |

Knock-in Feature (Airbag feature)

What is Airbag Feature ? |

Knock-out Feature

What is Knock-out Feature ? |

Principal protected at maturity

What is Principal protected at maturity ? |

||

|---|---|---|---|---|---|

|

|

Callable ELI –

Providing fixed amount of potential cash coupon periodically |

✔ | ✔ | ||

|

|

Potential Performance Return (PPR) ELI –

Providing floating amount of potential cash return at maturity |

✔ | |||

|

|

Knocked-Out Performance ELI –

Providing floating amount of potential cash return at maturity

|

✔ | ✔ | ✔ |

* Depending on issuer, fixed coupon for that period may not be distributed if the closing price of worst performing asset price is below the barrier price on the specified calculation period end date.

** Accrued potential cash dividend amount is calculated on a pro rata basis from (but excluding) the relevant calculation period start date to immediately preceding the call date.

# The at-expiry knock-in event condition subjects to offering document from respective issuers.

The above illustrative examples are hypothetical and provided for illustration purpose only. For the actual terms of the products, including but not limited to, the rate, tenor and features, please refer to the terms and conditions set out in the relevant offering and sales documents. The Bank is not making any representations or warranties of future movements of the exchange rates or products in providing the illustrative examples. They do not represent all possible gain or loss outcomes or describe all possible factors that may affect the final product payout. The illustrative examples are for reference only and please do not rely on them when making an investment decision

List below is the popular# HK stocks and US stocks linked to Equity-Linked Investment offered by CNCBI in the specified offer period^.

| Stock Name | Stock Code | Reference Fixed Cash Dividend Rate may reach* |

|---|---|---|

| BABA | 9988.HK | 18.49% p.a. |

| HKEX | 0388.HK | 17.48% p.a. |

| TRACKER FUND | 2800.HK | 14.31% p.a. |

| MEITUAN | 3690.HK | 29.63% p.a. |

| TENCENT | 0700.HK | 13.38% p.a. |

| PING AN | 2318.HK | 19.50% p.a. |

| JD | 9618.HK | 29.04% p.a. |

| CM BANK | 3968.HK | 18.00% p.a. |

| CHINA LIFE | 2628.HK | 22.55% p.a. |

| CCB | 0939.HK | 11.76% p.a. |

| Stock Name | Stock Code | Reference Fixed Cash Dividend Rate may reach* |

|---|---|---|

| NVIDIA CORP | NVDA | 32.60% p.a. |

| TESLA INC | TSLA | 31.15% p.a. |

| MICRON TECHNOLOGY INC | MU | 28.36% p.a. |

| MICROSOFT CORP | MSFT | 11.38% p.a. |

| APPLE INC | AAPL | 11.65% p.a. |

| AMAZON.COM INC | AMZN | 15.12% p.a. |

| ADVANCED MICRO DEVICES | AMD | 25.63% p.a. |

| ALPHABET INC-CL A | GOOGL | 13.58% p.a. |

ELI is not equivalent to time deposits or its substitute and provide no guarantee of return or yield on investment. It is NOT protected by the Deposit Protection Scheme in Hong Kong.

Sales data accords to CNCBI equity-linked investment sales record data within the aforementioned offer period.

*Fixed cash dividend rate is per annum and determined on quotation date by currency (HKD), tenor (6 months), exercise price (95%) and autocall price (110%) and it is for reference only.

#Popular Stock Underlyings refer to the HK and US Stocks which are the most frequently chosen as the underlying stocks of Equity-Linked Investment offered by CNCBI during the aforementioned offer period^, and are arranged in alphabetical order of stock code. The above information is past sales record and for reference only. It is not and shall not be considered as investment advice. It does not constitute any offer or solicitation of offer to subscribe, transact or redeem any investment products. If you would like to obtain the latest information on the relevant products, please contact our relationship manager. Suitability assessment is required before subscribing for the relevant products.

Interested to know more about ELIs? Please visit us at your nearest branch or contact us at 2287 6788.

We provide a wide range of investment products to help you seize investment opportunities, achieve your goals, and enjoy exclusive investment service offers.

Learn More

This webpage does not itself constitute any offer of, or invitation by or on behalf of China CITIC Bank International Limited (the "Bank") to any person to purchase or sell or acquire or invest in any investment products. You should not only base on this webpage alone to make investment decisions. China CITIC Bank International Limited is an authorized institution under the Banking Ordinance and is regulated by the Hong Kong Monetary Authority.

This webpage has not been reviewed by the Securities and Futures Commission of Hong Kong or any regulatory authority in Hong Kong.

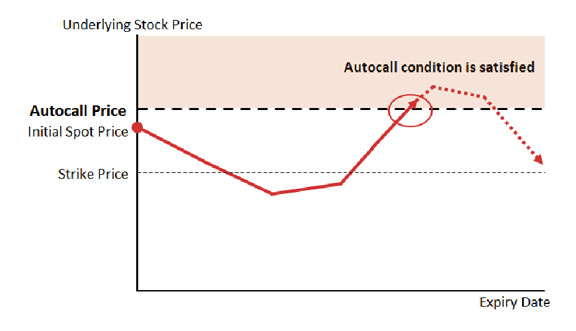

On or before the expiry date, if the closing price of the worst-performing asset is at or above the autocall price, the autocall condition is satisfied and the ELI will be early redeemed by issuer.

You will receive fixed potential cash coupon amount for each calculation period before the call date*; AND

You will receive fixed potential cash coupon amount for each calculation period before the call date*; AND

You will receive full redemption of the invested amount and any accrued potential cash coupon amount** on settlement date.

You will receive full redemption of the invested amount and any accrued potential cash coupon amount** on settlement date.

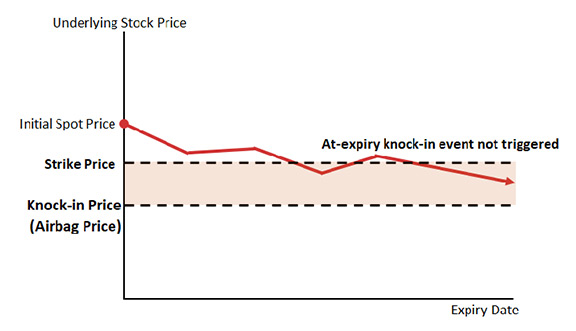

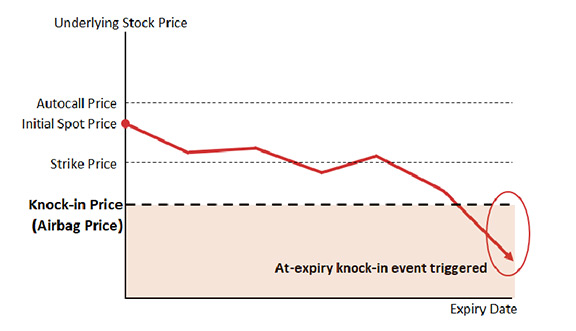

On expiry date, if the closing price of the worst-performing asset is below the strike price. The payoff will depend on whether its closing price is at or below its knock-in price (airbag price).

If its closing price is above the knock-in price#, the knock-in event is not triggered.

You will receive fixed potential cash coupon amount at each calculation period payment date*; AND

You will receive fixed potential cash coupon amount at each calculation period payment date*; AND

You will receive full redemption of the invested amount on settlement date.

You will receive full redemption of the invested amount on settlement date.

If its closing price is at or below the knock-in price#, the knock-in event is triggered.

You will receive fixed potential cash coupon amount at each calculation period payment date*; AND

You will receive fixed potential cash coupon amount at each calculation period payment date*; AND

You will receive physical settlement amount: a whole number of shares of the worst performing assets at strike price as of the expiry date and any fractional shares of the worst performing assets in cash.

You will receive physical settlement amount: a whole number of shares of the worst performing assets at strike price as of the expiry date and any fractional shares of the worst performing assets in cash.

Based on the final price, the market value of the shares will be worth less than your original investment.

Based on the final price, the market value of the shares will be worth less than your original investment.

In extreme case, the physical settlement amount could be worth nothing when the closing price drops to zero or issuer becomes insolvent and you could lose 100% of the initial investment amount.

In extreme case, the physical settlement amount could be worth nothing when the closing price drops to zero or issuer becomes insolvent and you could lose 100% of the initial investment amount.

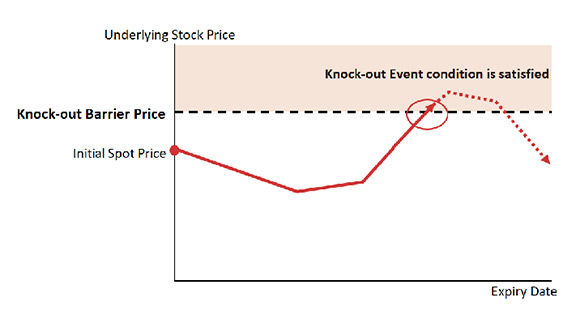

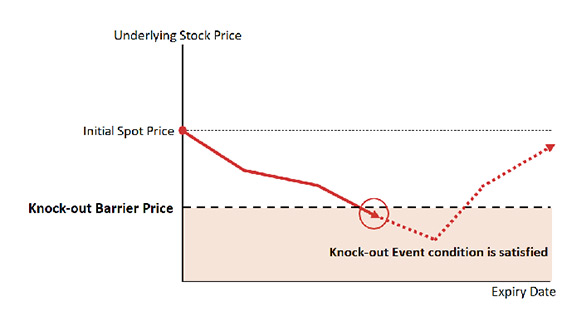

There is two types of Knock-out Feature, I) Bullish and II) Bearish.

I) Bullish

On or before the expiry date, if the closing price of the underlying stock is above the knock-out barrier price, the Knock-out Event is considered triggered and the cash distribution amount received at maturity will be fixed.

You will receive fixed potential cash distribution amount on settlement date; AND

You will receive fixed potential cash distribution amount on settlement date; AND

You will receive full redemption of the invested amount on settlement date.

You will receive full redemption of the invested amount on settlement date.

II) Bearish

On or before the expiry date, if the closing price of the underlying stock is below the knock-out barrier price, the Knock-out Event is considered triggered and the cash distribution amount received at maturity will be fixed.

You will receive fixed potential cash distribution amount on settlement date; AND

You will receive fixed potential cash distribution amount on settlement date; AND

You will receive full redemption of the invested amount on settlement date.

You will receive full redemption of the invested amount on settlement date.

Regardless of the reference stock’s performance, some ELIs provide fully or partially principal protection at expiry regardless of the reference stock’s performance. Principal protection level can be adjusted to earn higher potential return to match your investment objective.