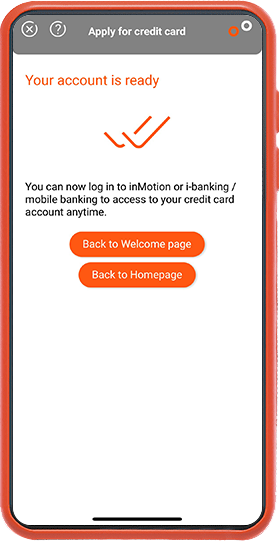

CNCBI Motion Credit Card(virtual) is a digital credit card which the card application and the retrieval of card details (e.g. card number, expiry date and CVV) are via inMotion. If you are CNCBI new customer, you may be able to get your credit card in around 15 minutes generally. If you are existing inMotion customer, you may able to get your credit card in around 5 minutes. After submitting your application, you will receive an email notifying your application status or you could log in to inMotion anytime to check your application status. You can use the CNCBI Motion Credit Card(virtual) for online shopping, mobile payments, mail and phone orders.

There is no plastic credit card issued for CNCBI Motion Credit Card(virtual). Yet, you can still enjoy mobile payment, online spending, phone/mail order with the card number, expiry date and CVV retrieved via inMotion. What’s more, e-statement and most of the communications will be sent to cardmember via electronic means to offer a holistic digital experience.

CNCBI New customer:

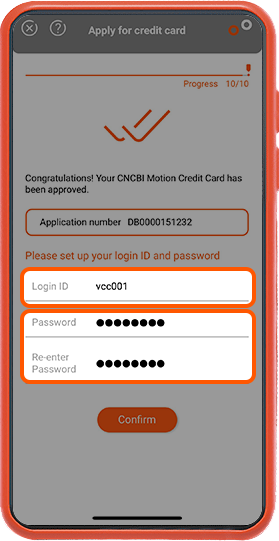

Simply download inMotion App from Apple App Store or Google Play and tap “New Customer Account Opening” then select “CNCBI Credit Card(virtual)” at the product selection page. Follow the instructions to complete the application at your fingertips.

New customer only need HKID, email address and mobile number for applying for CNCBI Motion Credit Card(virtual).

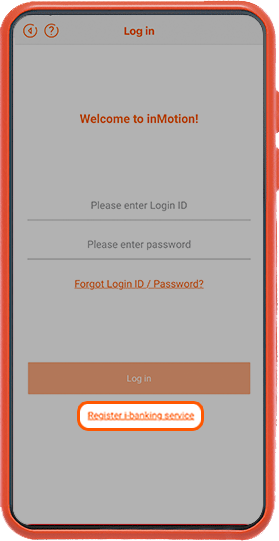

Existing inMotion customer:

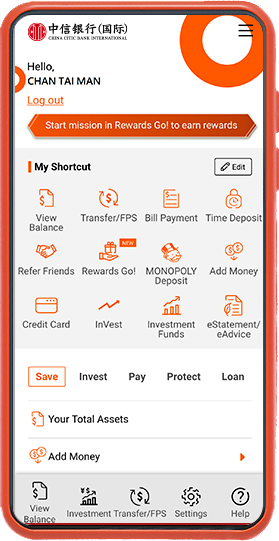

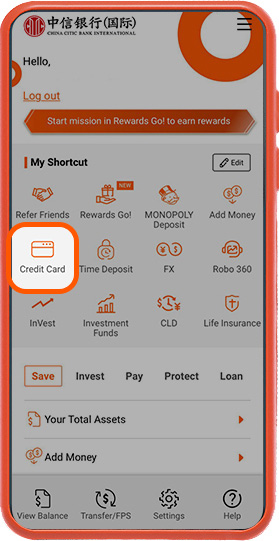

Log in to inMotion then select “Pay” and “Apply Credit Card” at Homepage, follow the instructions to complete the application.

Mostly, no income proof or address proof is required for both new customer and existing customer.

In some cases, we may require further documents for assessing your application. The approval of virtual credit card is based on the analytic result of customers' data.

For details of the application process, please refer to www.cncbinternational.com/vcc.

Sometimes we may need more time to process your application, for example, applications outside service hours will be proceeded in the next day. Our service hours are from 09:00 to 22:00 on Mondays to Saturdays and 12:00 to 21:00 on Sundays and Public Holidays. You will receive a notification email about the application progress after you have completed your application.

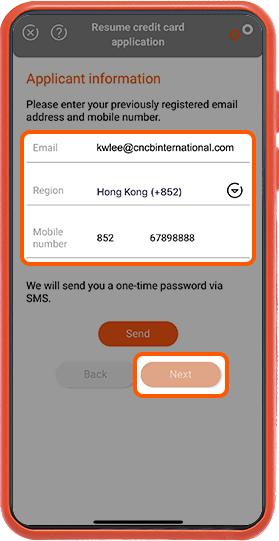

New customer:

Simply tap “Account opening status” on inMotion Welcome page, then enter your registered email address and mobile number for verification, you can view your CNCBI Motion Credit Card(virtual) application status afterwards.

inMotion existing customer:

Log in inMotion and select "Resume application" at Homepage, then verify your email address and mobile number, you can view your CNCBI Motion Credit Card(virtual) application status afterwards.

If you have applied for CNCBI Motion Credit Card(virtual), no plastic card will be issued. If you prefer a plastic credit card, please apply for other CNCBI credit cards and visit www.cncbinternational.com for details.

In order to provide the best digital credit card experience, most of our communications will be sent through electronic means and statements notification will only be sent via email and you are required to log in to our online banking or inMotion to check your statement. Therefore, no paper statement will be issued.

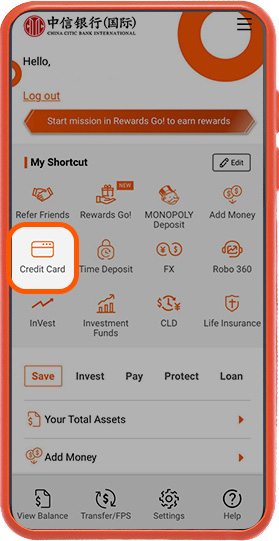

Apple Pay: Simply log in inMotion App of our bank and go to “Credit Card” page. Click "Add to Apple Wallet" and follow the instructions.

Google Pay: Open Google Pay app on your device and follow the instructions on Google Pay App to add your credit card. Then please contact our customer service hotline 2280 1288 for authentication and activation before Google Pay transactions as quick as possible.

Please note that when you add your CNCBI Motion Credit Card (virtual) to your mobile wallet, your CNCBI Motion Credit Card (virtual) is activated at the same time. It deemed that you have agreed to accept and to be bound by the Terms and Conditions of the respective Cardmember Agreement and other relevant terms and conditions set out by the Bank.

You can use the CNCBI Motion Credit Card(virtual) at any merchants who accept Apple Pay and Google Pay. Also, you can use it for online shopping and phone/ mail order. However, as no plastic card will be issued, you are recommended to understand whether physical credit card presentment will be required for collection of products or services before using the card for transactions made over the internet or phone.

Yes! Please note that Virtual Credit Card is not applicable to customer who terminated all his/her accounts and/or services with China CITIC Bank International Limited in the past 6 weeks immediately preceding the date of relevant card application via inMotion.

Yes! You can use it in the stores where Apple Pay or Google Pay is accepted, no matter for domestics or overseas payments. Online shopping, phone and mail orders of overseas merchants are also supported.

Yes, cash rebate Program is applicable to CNCBI Motion Credit Card(virtual). Please visit www.cncbinternational.com/personal/credit-cards/rewards-programs/en/index.jsp for details.

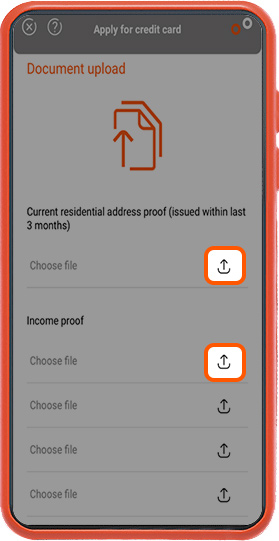

You can apply for credit limit increase of CNCBI Motion Credit Card(virtual) during or after CNCBI Motion Credit Card(virtual) application by submitting your latest address proof and income proof via inMotion. If you have uploaded your income and address proof at the time of application, the Bank will grant you an initial credit limit at the time of approval and review your submission and may adjust your credit limit afterwards.

During the application, for existing customers, you can simply follow the instructions and upload your income proof and address proof at “Document Upload” page. For new customers, after application, you can immediately upload the documents or you can tap “Pay” and “Upload document” to upload your income proof and address proof.

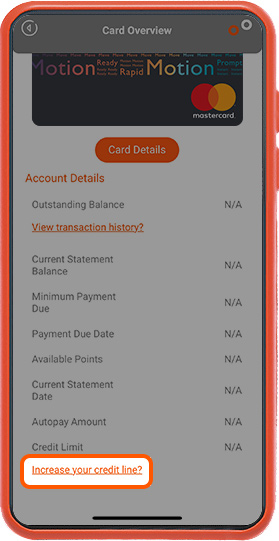

After the application, you can log in to inMotion and tap the “Increase your credit line?” button, and submit income proof and address proof according to the instruction.

During the assessment of your credit limit increase application, the Bank may review the related credit assessment report provided by credit reference agency. If you wish to access the report, please contact TransUnion at 2577 1816 or visit www.transunion.hk.

You may need to pay the related charges for accessing the report. The final credit limit amount is subject to the Bank’s final decision.

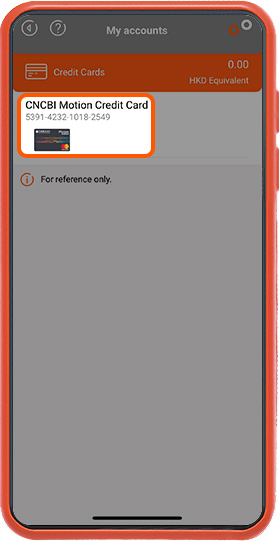

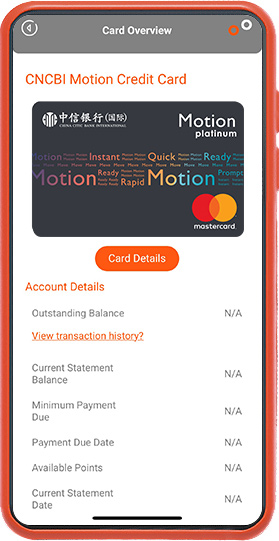

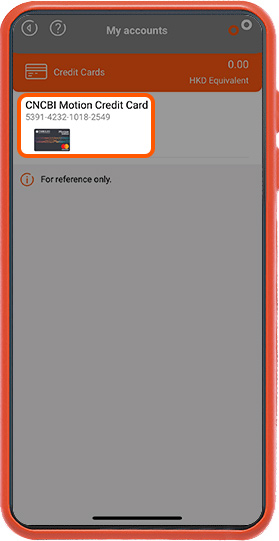

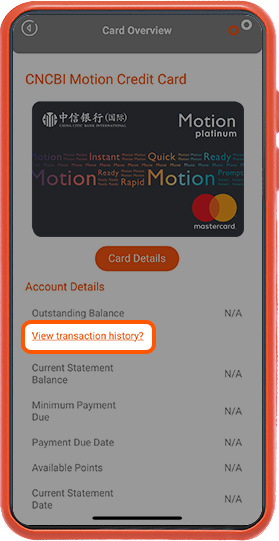

You can check your transaction via Transaction History or monthly e-Statement shown on inMotion or i-banking. For inMotion, simply go to credit card overview page to view the transaction history.

You are not recommended to use any “jailbroken” devices due to security reasons.

For Apple devices: If you need to return a purchase made with Apple Pay, you will have to present your digital credit card and request the merchant to issue the refund back on your credit card. For verification purposes, you may be asked to provide the last four digits of your Device Account Number to the merchant. This number can be found in the "Settings" menu in the Apple Pay app.

For Android devices: If you need to return a purchase made with Google Pay, you will have to present your digital credit card and request the merchant to issue a refund. For verification purposes, you may need to provide the last 4 digits of your Virtual Account Number to the merchant. This number can be found in the ‘Card details’ or ‘Transaction details’ of the Google Pay app.

Yes! You can apply for Octopus Automatic Add Value Service via i-banking or call our 24 hours’ customer service hotline at 2280 1288. For your convenience to activate your AAVS at MTR station, an activation letter will be sent via mail to your correspondence address.

For login ID, you can call our Customer Service Hotline at 2287 6889.

For password, if you have already set up your security questions, you may reset your password in inMotion. If you have not yet set up your security questions, you can call our Customer Service Hotline at 2287 6889.

After you have created your i-banking login, you could change your email address via i-banking. If you would like to change your mobile number, please go to any of CNCBI branches and request for changes.

You can call our Credit Card Customer Service Hotline at 2280 1288 to cancel your card.

Cash advance is not available for CNCBI Motion Credit Card(virtual).

Supplementary Card is not available for CNCBI Motion Credit Card(virtual). If you wish to apply for Supplementary Card, you are recommended to apply for other CNCBI credit cards first. Please visit www.cncbinternational.com/creditcard for details.

Yes! You can call our Credit Card Customer Service Hotline at 2280 1288 to request for a replacement card.

For the details of fee and chargers, please refer to https://www.cncbinternational.com/_document/personal/credit-cards/en/Credit-Card-Fee-Schedules.pdf.

There are several credit card repayment channels: Autopay, FPS, PPS, CNCBI branches (HK$20 handling fee per transaction for on over-the-counter payment at branch will be charged), WeChat Pay card repayment and cheque by mail.

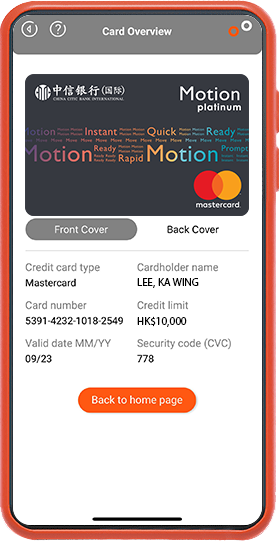

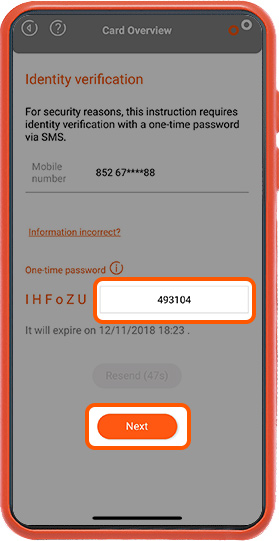

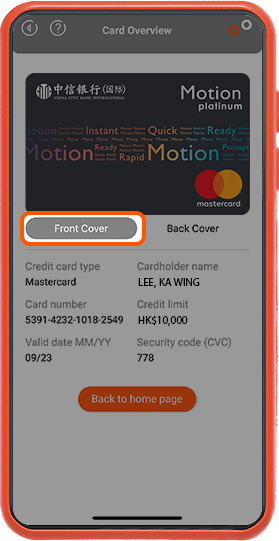

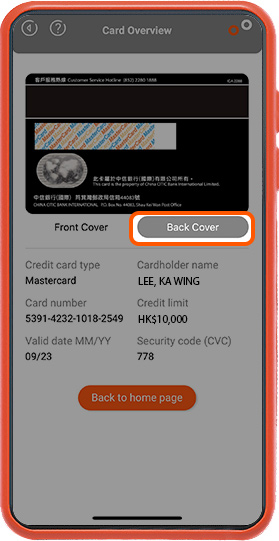

The card details can only be retrieved from inMotion. inMotion logon is password protected and two-factor authentication (in the form of SMS OTP) is required to re-authenticate customers' identity before the retrieval of the card details including card number, CVV and expiry date.

Card number, expiry date, CVV, credit limit, cardholder's name can be retrieved from inMotion. You should keep your card details safe and secure at all time. Also do not share/ authorize any third party to use your card in any manner, including mobile payment or online shopping.

- Please download the FREE inMotion from Apple Store or Google Play.

- Install and update the latest security application, anti-virus application and anti-spyware application regularly on your mobile devices.

- Never use inMotion in a mobile device with any pirated hacked, fake and/or unauthorized applications or in which the software lockdown has been overridden or root access to its software operating system has been obtained (such as, but without limitation, a "jailbroken" or a "rooted" mobile device).

- Make sure you are using supported versions of OS and applications of your mobile devices. Enable the auto-update feature to obtain and apply security patches regularly from trusted sources.

- Set a passcode for your mobile device that is difficult to guess and activate the auto-lock function.

- Disable any wireless network functions (e.g. Wi-Fi, Bluetooth, NFC) when not in use.

- Choose encrypted networks when using Wi-Fi and remove any unnecessary Wi-Fi connection settings.

For more online security's details, please visit inMotion "Online Security and Privacy" section under "Notice to customers".

If you suspect any fraudulent transactions or your card details have been lost or stolen or someone else knows, you should call our Credit Card Lost Card hotline (852) 3603 7899 immediately to report lost.

You should call our Credit Card Lost Card hotline (852) 3603 7899 immediately to report lost.

For more detailed security tips about inMotion, please refer to our online security tips.

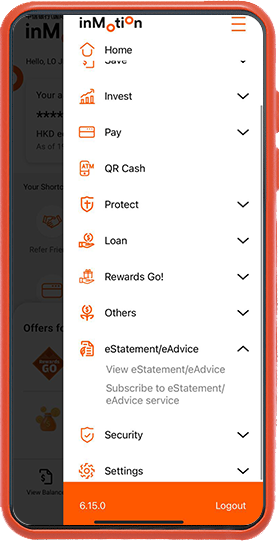

" on the upper right corner and select "eStatement/eAdvice“ to check the eStatement/eAdvice details

" on the upper right corner and select "eStatement/eAdvice“ to check the eStatement/eAdvice details