Header navigation:

One Account "Standby Secured Overdraft Facility"

With One Account "Standby Secured Overdraft Facility", you can now aim at any financial goal in your sight by enjoying the reserve liquidity. Mobilize your different assets to generate cash flow at any time you wish!

Combine Assets to Get Extra Cash Flow

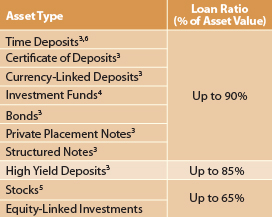

The One Account "Standby Secured Overdraft Facility" ("SSOD") lets you combine a wide range of assets for pledge, including time deposits, stocks, investment funds, bonds and other investment products. These assets can be used or traded freely for your flexible financial management1.

You can revolve your credit line with no minimum monthly repayment required1. Interest is charged only on the outstanding amount on a daily basis.

Flexibility on Trading Stocks

Once you have executed a sell order of Hong Kong stock, the expected incoming sell settlement funds will be treated as available funds for buying other investment products2 to maximize your opportunities.

One Account "Standby Secured Overdraft Facility" Loan Ratio Table:

Simple Approval with Daily Updated Credit Limit

Once the ceiling limit is approved, the available credit limit will be updated on a daily basis according to the current and newly added pledged asset value and the loan ratio without having to apply for further approval or submit additional documents7.

Dual Currency Flexibility

You can withdraw funds in either HKD or USD regardless of your facility currency and pay back in the same currency8, saving you the hassle of currency exchange and protecting you from the risks involved in the exchange.

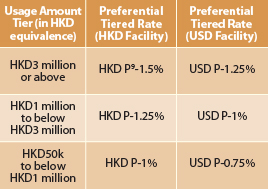

Preferential Interest Rates for Higher Usage

You can enjoy preferential interest rates which will be tiered based on the previous day-end outstanding balance, so the more you utilize, the lower the interest rate.

Remarks:

1 Not applicable to accounts with overlimit.

2 No cash out will be allowed for the unsettled stocks sales portion.

3 Approved currencies include HKD, USD, CNY, GBP, JPY, CAD, AUD, NZD, EUR and CHF.

4 Only applicable to selected non-hedge fund regulated under the Securities and

Futures Ordinance.

5 Only applicable to selected listed company stocks traded on HKEx securities market.

6 Time Deposits serving as a collateral to support SSOD will not be able to release the full or a portion of the principal upon maturity.

7 The Bank reserves the right to request additional documents for approval.

8 One Account "Deposit" will be the settlement account of One Account "Standby Secured Overdraft Facility". Credit balance in HKD One Account "Deposit" can be used as the collateral for USD SSOD or vice versa. Deposits to the One Account "Deposit" will be used for settlement of the SSOD in the same currency.

9 P denotes Prime Rates and refers to the HKD/USD Prime Lending Rate as quoted by China CITIC Bank International Limited (the "Bank") from time to time. Please refer to the Bank website or contact our customer representative for more information.

Terms and Conditions of One Account "Standby Secured Overdraft Facility"

Risks Associated with One Account "Standby Secured Overdraft Facility"

- Reminder:

"To borrow or not to borrow?

Borrow only if you can repay!"

- Application via branches

- Call us at 3603 3333 (Mondays - Saturdays : 9am - 9pm)

Be served by our professional staff at our branches, or opt for self-service banking via our automated channels — the choice is yours.

Careers

We offer a range of rewarding careers from trainee to management level.

Tap into the vast resources and network of our parent bank China CITIC Bank and our ultimate shareholder, CITIC Group Corporation.