Header navigation:

Debt Consolidation

Beat Credit Card Debt

It has never been easier to pay off all your outstanding debts in one simple loan

Successfully drawdown for $mart Plus Personal Installment Loan – Debt Consolidation, you can enjoy our Tax Season offer:

Up to HK$23,888 Cash Rebate1

- From now until 31 March 2026, customers who apply for and successfully draw down a loan amount of HK$100,000 or above with a repayment tenor of 36 months or above shall enjoy the relevant cash rebate1.

- Selected customers can enjoy up to HK$23,888 cash rebate1.

Product Features

- Flexible repayment tenor of 12 to 72 months

- Save interest expenses with personalized interest rate

- Loan amount as high as HK$2,000,000 or 21 times of your monthly salary (whichever is lower)

Why Choose This Loan

- Easily manage different loans and rebuild your credit history

- Our Debt Consolidation Specialist analyzes your financial situation and tailor-made with a flexible loan transfer plan to you

- Save significantly on unnecessary interest costs and improve your cash flow

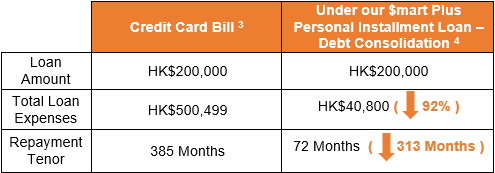

Interest Saving Example

Remarks:

- Customers successfully applying and drawdown for $mart Plus Personal Installment Loan including Personal Instalment Loan, Debt Consolidation and Top Up Loan (“Loans”) with loan amount of HK$100,000 or above and repayment tenor of 36 months or above during the period from now until 31 March 2026 shall be entitled to the corresponding Cash Rebate. Selected Customers will be eligible for Cash Rebate of up to HK$23,888, and other customers will be eligible for Cash Rebate of up to HK$12,888. For details, please refer to “$mart Plus Personal Installment Loan – Promotional Terms and Conditions for up to HK$23,888 Cash Rebate Offer”.

- The Bank reserves the right to determine the final approved amount, loan tenor and applicable interest rate in accordance with individual customer’s record.

- This example is calculated based on loan amount of HK$200,000, an annual interest rate of 30% (Annualized Percentage Rate (“APR”) 34.49%) charged by general credit card and a monthly repayment of all fees and charges billed to the credit card followed by 1% of the credit card outstanding balance or HK$250 (whichever is higher). The total repayment tenor is 385 months. The total loan expenses includes the full interest payments and is rounded to the nearest dollar.

- This example is calculated based on loan amount of HK$200,000, monthly flat rate 0.20% and loan tenor of 72 months, including a handling fee of 1% per annum (APR 6.90%). The total loan expenses includes the full interest payments and handling fee, and is rounded to the nearest dollar. The examples are for reference only. The APR will be determined based on the customer's credit rating and other relevant loan approval factors, and the bank reserves the final discretion to approve the loan application and to determine the applicable interest rate and handling fee.

- The APR is calculated in accordance with the practices and methods set out in the relevant guidelines issued by the Hong Kong Association of Banks. An APR is a reference rate which includes the basic interest rate and other applicable fees and charges expressed as an annualized rate.

- The Bank reserves the right of final decision in respect of all applications and approvals of Debt Consolidation and is under no obligation to provide reason.

$mart Plus Personal Installment Loan – Debt Consolidation

FAQs for $mart Plus Personal Installment Loan

Terms and Conditions for $martPlus Personal Installment Loan and General Terms and Conditions

$mart Plus Personal Installment Loan – Promotional Terms and Conditions for up to HK$23,888 Cash Rebate Offer

Dollar$mart Personal Installment Loan – Debt Consolidation (Not accept new application)

FAQs for Dollar$mart Personal Installment Loan

Terms and Conditions for Dollar$mart Personal Installment Loan and General Terms and Conditions

- Reminder:

To borrow or not to borrow?

Borrow only if you can repay!

Be served by our professional staff at our branches, or opt for self-service banking via our automated channels — the choice is yours.

Careers

We offer a range of rewarding careers from trainee to management level.

Tap into the vast resources and network of our parent bank China CITIC Bank and our ultimate shareholder, CITIC Group Corporation.