Header navigation:

Securities Trading Service Guide and FAQ

- General Information of Securities Trading Service

- Hong Kong Securities Trading Services

- China Connect Securities Trading Services

- U.S. Securities Trading Services

- EIPO

General Information of Securities Trading Service

- Login to ibanking

- Click Securities Trading (2-factor authentication is needed) > Choose Securities Trading Market (Hong Kong Securities Trading/China A-share Trading/US Securities Trading)

- Enter the required trading order details > Submit

- Verify the order details > Confirm

- A reference number will be displayed if the order is accepted by the system (you can check the order status via "Order Status / Amendment"

You can place an order on the Trade page, follow these steps:

- Enter the appropriate Stock Code or Symbol. (Please click on ”Code Search” if you do not know the Stock Code or Symbol for the security you wish to view.)

- Enter the number of shares to buy or sell in the Quantity field.

- Enter the Limit Prices (if applicable)

- Select Good Till Day (if applicable)

- Click 'Submit' button to preview the order or 'Clear' button to clear all fields and start from the beginning.

- Click 'Confirm' button to place your order.

An Order Confirmation will appear verifying that the order has been accepted for processing. A transaction number will also be issued to you.

Upon the Bank process the order, the purchase amount will be held. The actual debit of the money will take place on the settlement day. Money held between the placement day and the settlement day would continue to earn interest in your account.

You may select account in Order Placement page and then can choose "Total Available Balance For Trading". You can see by currencies buying power at a glance.

An online order confirmation with a transaction reference number will be provided to you immediately. This confirmation indicates that we have received your order instruction. You will need to check the order status by clicking to find out whether your order has been filled. The status shows the stage at which your order is being processed.

- Pending – Order is pending to process.

- Processing - Order is processing.

- Queuing - Order has not yet been filled.

- Fully executed - Order has been completely executed.

- Partially filled - Order has been partially executed.

- Expired - Order has not been executed due to the expiration of the time condition set.

- Rejected - Order has been rejected by particular reason.

Simply go to Securities Trading page (2-factor authentication is needed), then you can choose "Order Status / Amendment" to check your order status or execution result. Also, you may opt to receive email or SMS for execution result.

Simply go to Securities Trading page (2-factor authentication is needed)

- Click on "Order Status / Amendment".

- Select Amend from the Action column on the order intended to change and the Amend Order page will appear.

- Enter order changes as necessary in the fields provided. The existing order details are displayed on the left for comparison.

- An Order Confirmation will appear verifying that the order amendment has been accepted for processing. From here you can click the Trade Status link to check the order status.

Please note: Cancellation request will be promptly submitted to relevant exchanges for execution on a best effort. Any fully cancel request or open or partially filled order amended request cannot be guaranteed as the original order may be partially or fully executed. Cancellation or Amendment request is subject to the market conditions as well as prior execution of your original order.

Simply go to Securities Trading page (2-factor authentication is needed)

- Click on "Order Status / Amendment".

- Select Cancel from the Action column and the Order Cancellation page will appear.

- To confirm the cancellation of your order by clicking the Cancel Order button.

- Click the Cancel button if you have selected an incorrect order to cancel or you do not wish to cancel the order. If an error has occurred, the details will be displayed.

- A Confirmation page will appear verifying that the order cancellation has been accepted for processing. From here you can click the Order Status link to check the order status.

If you have an outstanding order that is not yet filled in the market, you may cancel it by clicking 'Cancel' on the Trade Status page to proceed the cancellation. Please note that cancellation request will be promptly submitted to relevant exchanges for execution on a best effort basis. Any fully cancel request or open or partially filled order amendment request cannot be guaranteed as the original order may be partially or fully executed. Cancellation or Amendment request is subject to the market conditions as well as prior execution of your original order.

All unmatched days orders will expire at the end of the Good Till Day. You will have to re-enter the order after the trading hours if you wish to keep the order for the next business day.

The withheld fund of the cancelled order will be released to Usable Balance for Trading immediately.

The order will be remarked in Trade Status as 'Expired' and withheld fund will be released to Usable Balance for Trading after Good Till Day market closed.

For purchases of the same stock via the same trading channel on the same trading day, the commission will be calculated based on the total transaction amount. This commission calculation method also applies to “sell” transactions. For the criteria of combine-trade, please refer to the following example.

Example:

A General customer bought and sold the same stock via inVest and inMotion for 4 times on the same trading day. Transaction details are as follows:

* Minimum charge of securities brokerage commission is HKD100

Not eligible for combine-trade:

1 & 2: Although inVest and inMotion are both the Bank’s mobile applications, with the same brokerage rate at 0.15%, they are regarded as two separate channels. Hence, the brokerage fee will be calculated based on the transaction amount purchased through inVest and inMotion respectively, ie HKD302.50 (=100.00+202.50)

Eligible for combine-trade:

3 & 4: Selling the same stock via inVest is eligible for combine-trade, so the brokerage fee will be calculated based on the total transaction amount sold through inVest, ie HKD225.00 (=(15,000+135,000)X 0.15%).

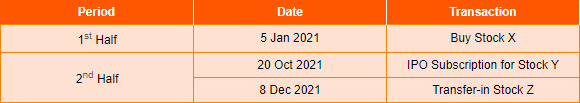

Customers who maintain any stock holding with the Bank and do not conduct any securities transactions (including buy or sell transactions) within a 6-month period (January to June/ July to December) will be subject to the Securities Custodian Fee. This fee is charged semiannually for the period between January and June as well as July and December, and is debited respectively in July of the year and January of the following year. For transactions which fulfil the criteria of Securities Custodian Fee waiver, please refer to the following example.

Example:

Below are the transactions conducted by a customer:

1st half: The customer has a buy transaction in the first half year of 2021 which meets the criteria for waiver of Securities Custodian Fee. Therefore, no Securities Custodian Fee will be charged in Jul 2021 for the first half of 2021.

2nd half: IPO subscription and Securities transfer-in/out are not recognised as securities buy/sell transaction. As customer is holding Stock X, Securities Custodian Fee will be charged in Jan 2022 for the second half of 2021.

The "Average Cost" is calculated using the weighted average purchases price and charge information available to the Bank, and the amount is displayed for indication only.

If you have US securities bought on or before 27 Feb 2015, the market closing price of 27 Feb 2015 is used as the weighted Average Cost of such holdings.

Yes, at present, the per order transaction limit for Securities Trading transaction is HK$5,000,000 or equivalent.

You will receive a Trade Confirmation whenever there is a transaction in your trading account. Monthly statements will be sent to you within the first seven business days of each calendar month, showing all securities balance and all your transaction activities within the previous month. Alternatively, you can access your account information online.

Duplicate statements can be issued on request. Please apply for reprints through our Securities Trading Service Hotline. Additional charges may apply.

You can visit our branch or contact us over the phone (For Hong Kong and SSE Securities Trading, please call 2287 6088. For U.S. Securities Trading, please call 2287 6688).

- Why I need to perform 2-factor authentication for securities trading/enquiries via online platforms?

To strengthen the security level for online transactions, 2-factor authentication is required for any securities trading/enquiries via online platforms.

Hong Kong Investor Identification Regime (HKIDR)

HKIDR applies to securities listed or traded on the Stock Exchange of Hong Kong ("SEHK”) . The Bank will have to assign a Broker-Client Assigned Number (“BCAN”) to each client and tag the BCAN to securities orders. The Bank will also have to submit to SEHK’s data repository the client identification data (“CID”) (including full name, issuing country or jurisdiction of identity document, identity document type and identity document number) of securities orders on SEHK or who conduct off-exchange trades reportable to SEHK.

HKIDR does not apply to derivatives traded on the trading system of the Hong Kong Futures Exchange, unlisted structured products ( e.g. equity linked instruments, equity linked notes) and delivery of SEHK listed securities pursuant to these products.

Currently, the Securities and Futures Commission (“SFC”) can only identify exchange participants (ie, brokers) which place securities orders directly through the SEHK trading system. When the SFC detects suspicious trading activities, it needs to seek information from brokers about the actual investors behind the trades. This limits the effectiveness of its market surveillance work. With an investor identification regime, the SFC could quickly obtain information about investors who place orders. This will enhance the SFC’s market surveillance function, help maintain market integrity and strengthen investor protection, thereby promoting the long-term development of the market.

The information in the data repository is encrypted and is only accessible by authorised personnel of the SFC and SEHK. Data security and access control measures will be updated regularly with the latest technological developments. Detailed audit trails are maintained of all access, and unauthorised access will be investigated.

SFC has imposed a waterfall for acceptability of identity document for the CID in which the identity document that is first mentioned in the list below should be adopted as first priority save that where you do not hold such document, the next mentioned document should be used and so forth.

In the case of a corporate, it would be (1) legal entity identifier; or (2) certificate of incorporation; or (3) business registration certificate; or (4) other equivalent documents.

In the case of a natural person, it would be (1) Hong Kong Identity Card (“HKID card”); or (2) national identification document; or (3) passport.

Exit-entry Permit for Travelling to and from Hong Kong and Macao and Permit for Proceeding to Hong Kong and Macao are travelling documents issued by the Mainland authorities to PRC residents. They are neither national identity documents nor passports. If you are a PRC resident without HKID, you should provide information to the Bank on respective mainland identity cards (national identity document) as CID, or in the absence of a mainland identity cards, the information on passports.

Under paragraphs 5.6(p) and 5.7(h) of the Code of Conduct for Persons Licensed by or Registered with the SFC, the Bank would need to obtain express consent from individuals (except corporates) for disclosing and transferring your personal data to the SEHK and/or any of its subsidiaries, SFC, and/or any of its subsidiaries and the Bank’s securities broker(s) in accordance to with the rules and requirements of the SEHK and the SFC in effect from time to time. For joint account, HKIDR consent instruction must be solicited from all holders whereas CID of all holders are required to be submitted to SEHK’s data repository.

HKIDR will be implemented tentatively in the second half of 2022, subject to the latest regulatory announcement.

Failure to provide the Bank with your personal data or consent or required CID as per waterfall requirement prior implementation of HKIDR may mean that the Bank will not, or will no longer be able to, as the case may be, carry out your trading instructions, IPO application or provide me/us with securities related services (other than to sell, transfer out or withdraw my existing holdings of securities, if any) after the implementation of HKIDR.

The above applies to joint-name accounts as well, i.e. failure of any of the account holders to provide personal data or consent or required CID as per waterfall requirement prior implementation of HKIDR will also subject to the above restrictions. Even if you submit the consent instructions and CID as per acceptability described above after the effective date of HKIDR, it may not be effective immediately.

To avoid unwanted limitations to your account, you can provide consent regarding HKIDR via inMotion, inVest, i-banking or automated securities trading hotline.

You can visit any branches or contact your Relationship Manager to fill in the Investor Identification Regime for Hong Kong Securities Consent Form. Despite any subsequent purported withdrawal of consent, your personal data may continue to be stored, processed, used, disclosed or transferred for the purposes outlined in Customer Declaration section after such purported withdrawal of consent.

Please note that it will take time for the Bank to process your submission of consent instructions and/or CID updates as per acceptability described above and your instructions/updates may not be effective immediately. You are advised to submit the above consent instructions and notify the Bank for any material changes of CID as soon as possible to avoid unwanted limitations to your transactions after the effective date of HKIDR (second half of 2022).

You can visit our branch and contact your Relationship Manager (if applicable) or seek assistance via branch staff.

HKIDR will also be extended to initial public offerings (“IPO”) applications, tentatively to be implemented in the fourth quarter in 2022, subject to the latest regulatory announcement.

SFC: https://www.sfc.hk/en/Rules-and-standards/Investor-Identification-and-OTC-securities-reporting

HKEX: https://www.hkex.com.hk/Services/Trading/Securities/Overview/Trading-Mechanism/HKIDR?sc_lang=en

Hong Kong Securities Trading Services

You can trade Hong Kong Securities through the following channels:

- i-Banking service

- inVest

- inMotion*

- Automated Securities Trading Hotline

- Manned Securities Trading Hotline

* Please refer to the FAQ inside inMotion for more information about securities trading on inMotion.

You may choose:

- At-Auction Limit Order

- Enhanced Limit Order

- Market Order

- Take Profit Order

- Stop Loss Order

Simply go to "HK Securities Trading" page under "Securities Trading"(2-factor authentication is needed), then you can choose "Sell Odd-lot", and enter your Odd-lot disposal order. Please note that no Odd-lot purchasing order is accepted.

You can make use of "Good Till Date" (GTD) feature to place an order, which can valid for a maximum of eight trading days. The order with this feature will be treated as At-auction Limit Order when carrying forward to next day, and will be handle in Pre-opening Session. Please note that the order will not be carried to next trading day if it was partially executed, full executed, cancelled or rejected.

We only accept At-auction Limit Order within 199-price spread and Enhanced Limit Order within 23-price spread of the nominal price. Instructions that out of the spread will be rejected.

| Price from (HK$) | Minimum Spread |

|---|---|

| 0.01 | 0.001 |

| 0.25 | 0.005 |

| 0.50 | 0.010 |

| 1.00 | 0.010 |

| 2.00 | 0.010 |

| 5.00 | 0.010 |

| 10.00 | 0.020 |

| 20.00 | 0.050 |

| 100.00 | 0.100 |

| 200.00 | 0.200 |

| 500.00 | 0.500 |

| 1000.00 | 1.000 |

| 2000.00 | 2.000 |

| 5,000.00 to 9,995.00 | 5.000 |

Simply go to "HK Securities Trading" under "Securities Trading"(2-factor authentication is needed), then you can choose "Order Status / Amendment" to amend or cancel your order. Please note that confirmed odd-lot selling order instruction cannot be amended or cancelled.

Yes, you can check, amend or cancel your order by cross channels, i.e. you may do it via Automated Securities Trading Hotline, Manned Securities Trading Hotline.

Hong Kong Securities Trading will follow HKEX settlement cycle. Securities and money settlement will be on T+2 day.

When doing Dual Counter (RMB and HKD counters) securities trading, please note that issuers may pay dividends in RMB only.

The securities under the Nasdaq-Amex Pilot Program (PP) are aimed at sophisticated investors. You should consult the licensed or registered person and become familiarized with the PP before trading in the PP securities. You should be aware that the PP securities are not regulated as a primary or secondary listing on the Main Board or the Growth Enterprise Market of The Stock Exchange of Hong Kong Limited.

Special Purpose Acquisition Companies (SPAC)

A special purpose acquisition company (SPAC) is a type of company that has no operating business and is established for the sole purpose of conducting a transaction (De-SPAC Transaction) in respect of an acquisition of, or a business combination with, a target, within a pre-defined time period, to achieve the listing of the target (Successor Company). SPAC Shares are a listed class of shares issued by a SPAC; while SPAC Warrants are a listed class of warrants issued by a SPAC that entitle the holders, upon exercise, to subscribe or purchase shares in a Successor Company.

Only Professional Investors (PI), in accordance with the SFC Code of Conduct, are allowed to buy SPAC Shares and SPAC Warrants listed on the Main Board.

China Connect Securities Trading Services

China Connect - refers to the mutual market access between the SEHK and SSE/SZSE, this is a programme that links the stock markets in Shanghai/Shenzhen and Hong Kong for securities trading and settlement established by SEHK, SSE/SZSE, HKEX and ChinaClear.

Southbound Trading Link (STL) - Eligible investors in Mainland China can place orders to trade eligible shares listed on the SEHK through Mainland securities firms and a securities trading service company established by SSE/SZSE by routing the orders to the SEHK. The eligible securities include the constituent stocks of the Hang Seng Composite LargeCap Index and the Hang Seng Composite MidCap Index, and the shares of all companies listed on both the SSE/SZSE and SEHK.

Northbound Trading Link (NTL) - Hong Kong and overseas investors can place orders to trade eligible shares listed on the SSE/SZSE through their local brokers and a securities trading service company established by the SEHK by routing the orders to the SSE/SZSE. Shares eligible to be accepted as an 'SSE Securities' to trade through NTL shall comprise all constituent stocks of the SSE180 Index and SSE380 Index, and shares of all SSE-listed companies that have issued both A and H shares (excluding shares that are not traded in RMB and those under risk alert board). Shares eligible to be accepted as an ‘SZSE Securities’ to trade through NTL shall comprise all Constituent stocks of SZSE Component Index and SZSE Small/Mid Cap Innovation Index, Companies with market capitalization at least RMB6B and SZSE-listed companies that have issued both A and H shares (excluding shares that are not traded in RMB and those under risk alert board).

You can trade SSE/SZSE Securities through the following channels:

- i-Banking service

- inVest

- Automated Securities Trading Hotline

- Manned Securities Trading Hotline

Only Limit Order is accepted.

The settlement arrangement will be different to Hong Kong Securities Trading. Northbound Trading will follow SSE/SZSE A-share settlement cycle. Securities settlement will be on T day, while money settlement will be on T+1 day.

No. Day trading is not allowed for Northbound Trading. Therefore, you can only sell the shares on and after T+1 day. Besides, you can use the fund from selling the SSE/SZSE securities to buy another SSE/SZSE Securities at the same day.

Order amendment is not allowed for Northbound Trading. If you want to amend your trading order, you have to cancel the order first and place a new order after successfully cancelled.

You have to pay third-party charges such as handling fee, securities management fee, transfer fee, stamp duty as well as bank charges such as brokerage commission fee. For details, please refer to the Investment Products Service Fees and Charges. The fees will be charged in Renminbi.

Investors will not be able to buy SSE/SZSE Securities under the following circumstances:

a) the SSE/SZSE Securities cease to be a constituent stock of the relevant indices;

b) the SSE/SZSE Securities are under risk alert board;

c) the corresponding H share of the SSE/SZSE Securities cease to be traded on SEHK;

d) the Daily Quota Balance drops to zero or below;

The board lot size of all SSE/SZSE Securities is 100 shares (buy orders must be in board lot). Odd lot trading is only available for sell orders (Odd lot sell order must be placed in one go). The price spread for SSE/SZSE Securities is uniformly set at RMB0.01. The maximum order size is one million shares.

Yes, the executed quantities of your buy order may result in odd lots.

Northbound Trading arrangement under severe weather conditions will be as follows:

- If SSE/SZSE is suspended due to bad weather, Northbound Trading will not open and SEHK will inform Hong Kong market accordingly.

- If typhoon signal number 8 (or above) and/or black rainstorm warning is issued in Hong Kong before Hong Kong market opens, Northbound Trading will not open. If the signal/warning is subsequently discontinued on the same day, arrangement for the resumption of Northbound Trading will follow that for the SEHK market (detailed arrangement is available on the HKEX website at http://www.hkex.com.hk/eng/market/typhoons/tradingarrangement.htm).

- If typhoon no. 8 (or above) is issued in Hong Kong after Hong Kong market opens but before SSE/SZSE market opens (between 9:00 a.m. and 9:15 a.m.), Northbound Trading will not open.

- If typhoon signal number 8 (or above) is issued in Hong Kong after SSE/SZSE market has opened, trading will terminate in 15 minutes after the signal was issued. Thereafter, only order cancellation will be accepted until SSE/SZSE market closed.

| Scenarios | Northbound Trading Arrangement | Hong Kong Market today |

|---|---|---|

| T8/Black rainstorm issued before HK market opens (i.e. before 9:00 a.m.) | Not open | Not open |

| T8 issued between 9:00 a.m. and 9:15 a.m. | Not open | Trading terminates after Pre-opening Session |

| T8 issued after SSE/SZSE market opens (i.e. 9:15 a.m.) | Trading terminates in 15 minutes after T8 issuance, thereafter only order cancellation is allowed until SSE/SZSE market closes | Trading terminates in 15 minutes |

| Black rainstorm issued after HK market opens (i.e. 9:00 a.m.) | Trading continues as normal | Trading continues as normal |

| T8/Black rainstorm discontinued at or before 12:00 noon | Trading resumes after 2 hours | Trading resumes after 2 hours |

| T8/Black rainstorm discontinued after 12:00 noon | Not open | Not open |

No. China Connect does not support IPO.

You can visit HKEX website's "China Stock Markets Web" to obtain information on SH-HK Connect, such as Information Book for Investors, Frequently Asked Questions for Investors, list of eligible stocks, quota balance, etc.

(

Comparison between trading China A shares and Hong Kong stocks in Hong Kong

| Trading Shanghai A shares in Hong Kong | Trading Shenzhen A shares in Hong Kong | Trading Hong Kong Stocks in Hong Kong | |

| Stocks available for trading | - Constituent stocks of the SSE 180 Index - Constituent stocks of the SSE 380 Index - A shares listed on both HKEX and SSE (excluding Shanghai A shares on the risk alert board and those that are not traded in RMB) |

-Constituent stocks of the SZSE Component Index and SZSE Small/Mid Cap Innovation Index -Companies with market capitalization at least RMB6B -SZSE-listed companies that have issued both A and H shares(excluding Shenzhen A shares on the risk alert board and those that are not traded in RMB) |

All stocks listed on HKEX |

| Quota | Daily Quota: RMB 52 billion | Daily Quota: RMB 52 billion | No limit |

| Settlement currency | RMB | RMB | HKD |

| Board lot size | 100 shares per each board lot | 100 shares per each board lot | Depends on the stock |

| Price limit | Order price cannot exceed +/-10% of the previous closing price | Order price cannot exceed +/-10% of the previous closing price | No limit |

| Tick size | RMB 0.01 | RMB 0.01 | Vary from HK$0.001 to HK$5, depending on the stock price |

| Trading hours | Opening Call Auction: 09:15-09:25 Continuous Auction(Morning): 09:30-11:30 Continuous Auction(Afternoon): 13:00-15:00 |

Opening Call Auction :09:15-09:25 Continuous Auction (Morning): 09:30-11:30 Continuous Auction(Afternoon): 13:00-14:57 Closing Call Auction:14:57-15:00 |

Pre-opening session: 09:00-09:30 Morning session: 09:30-12:00 Extended Morning Session: 12:00-13:00 Afternoon session: 13:00-16:00 Closing Auction Session: 16:00-16:10 |

| Trading days | All business days on which both markets are open for trading and banking services are available in both markets on the corresponding money settlement days | All business days on which both markets are open for trading and banking services are available in both markets on the corresponding money settlement days | All HKEX trading days |

| Clearing and settlement | Stocks clearing: T day Funds settlement: T+1 day |

Stocks clearing: T day Funds settlement: T+1 day |

Stocks clearing and funds settlement: T+2 days |

| Day trading | Not allowed. Stocks purchased on T day can only be sold on or after T+1 day | Not allowed. Stocks purchased on T day can only be sold on or after T+1 day | Allowed |

| Fees and tax | - Handling Fee (charged by SSE): 0.00487% of the transaction amount - Securities Management Fee (charged by China Securities Regulatory Commission): 0.002% of the transaction amount - Transfer Fee (0.002% charged by ChinaClear & 0.002% charged by HKSCC): 0.004% of the transaction amount - Stamp Duty (charged by State Administration of Taxation): 0.1% of the transaction amount (for sell trade only) |

- Handling Fee (charged by SZSE): 0.00487% of the transaction amount - Securities Management Fee (charged by China Securities Regulatory Commission): 0.002% of the transaction amount - Transfer Fee (0.002% charged by ChinaClear & 0.002% charged by HKSCC): 0.004% of the transaction amount - Stamp Duty (charged by State Administration of Taxation): 0.1% of the transaction amount (for sell trade only) |

- Transaction Levy (charged by SFC) : 0.0027% of the transaction amount - Trading Fee (charged by HKEX): 0.005% of the transaction amount - Stamp Duty (charged by HKSAR Government): 0.1% of the transaction amount (minimum charge : HK$1) |

Inclusion of ETFs in Stock Connect

When the inclusion takes effect, trading of eligible SSE-listed ETFs through Shanghai Connect and trading of eligible SZSE-listed ETFs through Shenzhen Connect will be open to all Hong Kong and overseas investors including institutional and individual investors.

You have to pay third-party charges such as handling fee, transfer fee as well as bank charges such as brokerage commission fee. For details, please refer to the Investment Products Service Fees and Charges. The fees will be charged in Renminbi.

Restricting Mainland investors from Northbound Trading under Stock Connect

Effective from 25 July 2022 onwards, the China Securities Regulatory Commission restricts mainland investors from participating in the Northbound Trading under Stock Connect.

As such, mainland investors who open One-Accounts on or after 25 July 2022 are not allowed to trade/transfer in China Connect Securities through Northbound trading. Mainland investors who have already opened One-Accounts before 25 July 2022 will be subject to a 1-year transitional period.

Mainland investors include individuals that possess Mainland ID documents (holders of a joint account if one of the holders is considered as Mainland investor) and corporate or unincorporated entities which are registered in the Mainland, excluding any individual who has obtained an identity document as proof of permanent residence in a country or region outside Mainland China.

Any branch or subsidiary of a corporate or unincorporated entity registered in Mainland China which branch or subsidiary is lawfully registered in Hong Kong or overseas is not considered as Mainland investor.

The Bank will enforce the regulatory authorities restrictions on Mainland investors from participating in the Northbound Trading under Stock Connect according to the customer's identity document records in the Bank.

1-year transitional period from 25 July 2022 to 23 July 2023, existing Mainland investors could still buy and sell China Connect Securities through Northbound Trading under Stock Connect.

After the transitional period (from 24 July 2023), existing Mainland investors could not actively buy China Connect Securities through Northbound Trading under Stock Connect (including subscription for right issues, but excluding obtaining China Connect Securities passively as a result of corporate actions (such as distribution of stock dividends)), existing China Connect Securities held by Mainland investors could be sold; The Northbound Trading rights of Mainland investors without holding of China Connect Securities shall be cancelled by Hong Kong brokers in a timely manner.

If you have opened a One-Account before 25 July 2022, you can continue to trade China Connect Securities through Northbound Trading until 23 July 2023. From 24 July 2023, you will not be able to buy China Connect Securities through Northbound Trading, but you can still sell out your holding China Connect Securities.

If you open a One-Account on or after 25 July 2022, you will not be able to trade/transfer in China Connect Securities through Northbound Trading.

From 25 July 2022 onwards, for new One-Account opening, it is expected that trading of China Connect Securities through Northbound Trading will be available on the next trading day after the account opening at the earliest.

You must update your identity document in the Bank to trade China Connect Securities through Northbound Trading. For the channels of updating your identity documents, you can visit our branch and contact your Relationship Manager (if applicable) or seek assistance via branch staff.

For more details, please refer to the latest announcement of the Hong Kong Stock Exchange on restricting mainland investors from participating in the Northbound Trading under Stock Connect.

Reference: https://www.hkex.com.hk/-/media/HKEX-Market/Services/Circulars-and-Notices/Participant-and-Members-Circulars/SEHK/2022/CT08822c.pdf

U.S. Securities Trading Services

Our U.S. Securities Trading Service provides trading and custodian services for U.S. stocks listed in NYSE Equities Market and NASDAQ Stock Market. However, we do not accept any BUY order in any stocks with a market cap below USD 50 million and the price per share less than USD 0.50.

You can trade U.S. Securities through the following channels:

- i-Banking service

- inVest

Existing customer can open a trading account through online platforms. To activate US securities trading service, customer need to complete W-8BEN Form and upload via inMotion or return to our branch either in person or by mail. (The latest W-8BEN Form can be downloaded from Internal Revenue Service: https://www.irs.gov/pub/irs-pdf/fw8ben.pdf). Please note US securities trading service is not applicable for US persons.

W-8BEN Form is a declaration form from Internal Revenue Service of the U.S. for investor to declare their identity of non-US citizenship. It is required to be renewed in every 3rd full succeeding years. Otherwise, the bank is not able to offer your U.S. Securities Trading Service continuously after the last W-8BEN is expired.

- North Hemisphere Summer - 21:30 - 04:00 Hong Kong time

- North Hemisphere Winter - 22:30 - 05:00 Hong Kong time

North Hemisphere Summer commences at 2am on the second Sunday of March of the year. North Hemisphere Winter commences at 2am on the first Sunday of November of the year. You can place an order through online banking from 19:30 (Hong Kong time) until the close of the US securities market

Securities purchased can be sold immediately. The sale proceeds will be credited to your account 2 days after the sales execution (i.e. T+2).

Yes, trading will be available if US securities markets are open.

There is no capital gain tax for non-US persons on trading US securities. However, non US person are subject to a 30% withholding tax on dividends. This is not a tax advice and any tax related questions should be referred to their own individual tax consultant.

US SEC Fee is the Sales Tax as stated in Investment Products Service Fees and Charges of the Bank, it was created by the Securities Exchange Act of 1934 to be an additional transaction cost attached to the selling of exchange-listed equities. This fee is usually listed as a separate fee, independent of any associated brokerage commissions or fees. The fee will be revalued by the US Securities and Exchange Commission from time to time.

If you have any enquiries, you can contact our US Securities Service Hotline at (852) 2287 6688 for assistance.

Service Hours (Hong Kong Time):

Monday to Friday: 9am to next day 6am#

Saturday: 9am to 8pm#

#Except HK/US public holidays

Major Changes in the U.S. Withholding Mechanism for Publicly Traded Partnerships (PTP) Securities

A PTP is any partnership an interest in which is regularly traded on an established securities market or is readily tradable on a secondary market, regardless of the number of its partners.

The U.S. Internal Revenue Service (IRS) recently announced additional withholding on the transfer of interests in the publicly traded partnerships (PTPs) held by non-U.S. investors in accordance with Section 1446(f) of the Internal Revenue Code (IRC Section). The latest regulations on withholding and information reporting of relevant subjects, which will come into effect on January 1, 2023. After taking effect, non-U.S. investors will incur the following U.S. tax costs when they hold/sell, trade, or transfer PTP-related subjects for compensation:

- - When receiving dividends/ interest: 37% withholding tax will be levied on the allotted amount;

- - When selling, trading or transferring PTP subject matter for compensation: 10% of the "total price" obtained will be deducted.

In order to reduce the complex US withholding risks and impacts arising from investing in these commodities, the Bank shall no longer accept trading instructions to buy PTP-related targets from now onwards.

The customers can still sell/transfer out the original holdings of PTP related subjects through the original trading channel. The Bank will completely suspend or restrict the sale, trading or other transfer of PTP subject matter (including any transactions with exceptions listed in the regulations) from 28 Dec 2022.

Relevant information is based on the current IRS announcements and decrees. The implementation may be different due to future changes in regulations. The Bank will not notify any changes in the relevant laws and regulations on PTP products, but investors should pay attention to their own investment positions, the development of laws and regulations and understand their impact on their own rights.

If you hold PTP-related subjects, please consult your tax advisor as soon as possible to understand the tax costs derived from holding, trading or other paid transfer of PTP and the impact on the rights and interests related to asset allocation, and refer to your tax advisors of the company recommendation or consider at your own discretion whether to dispose of the sale before the end of 2022.

Relevant information is based on the current IRS announcements and decrees. Investors are advised to pay attention to the relevant announcements on the IRS official website.

The industry has announced a tentative list of affected PTPs on the many forums. The list is based on market peer information and notices from financial institutions in the United States, but The Bank cannot guarantee the completeness of the list. Moreover, the list may evolve as more peer information becomes available in future. Investors are advised to pay attention to the relevant announcements on the Internal Revenue Service (IRS) official website.

Examples such as ProShares Ultra Gold (UGL) 、Invesco DB Agriculture Fund (DBA)、United States Oil Fund LP (USO) 、ProShares Ultra Bloomberg Crude Oil (UCO)、ProShares Ultra VIX Short-Term Futures E (UVXY) 、ProShares Ultra Silver (AGQ)、Invesco DB US Dollar Index Bullish Fund (UUP)、Teucrium Wheat Fund (WEAT)、United States Copper Index Fund (CPER)、ProShares UltraShort Bloomberg Crude Oil (SCO) 、Enterprise Products Partners LP (EPD), etc.

Virtual asset exchange-traded funds (VA ETFs) and exchange-traded products (VA ETPs)

“Virtual assets” refers to digital representations of value which may be in the form of digital tokens, such as utility tokens, stablecoins or security- or asset-backed tokens) or any other virtual commodities, crypto assets or other assets of essentially the same nature, but excludes digital representations of fiat currencies issued by central banks.

“VA-related products” refers to investment products which: (a) have a principal investment objective or strategy to invest in virtual assets; (b) derive their value principally from the value and characteristics of virtual assets; or (c) track or replicate the investment results or returns which closely match or correspond to virtual assets.

These VA ETFs/VA ETPs are temporarily not available for trade by the Bank.

EIPO

IPO represents Initial Public Offering where a company, for its first time, issues shares to investors and get listed on a Stock Exchange.

Our EIPO service aims to provide an access to subscribe (yellow form application) newly listed shares from Initial Public Offering via the internet.

Eligible applicant must:

- be our i-banking customer (personal customer);

- be an individual applicant;

- have a valid One Account “Investment” (yellow form application);

- Some companies may accept IPO applications from non Hong Kong residents. Please refer to respective Prospectus for details.

Step 1

Read the Prospectus thoroughly before making your decision to subscribe the shares under IPO. The electronic prospectus is available under "Securities Trading"(2-factor authentication is needed) > "EIPO" in this website.

Step 2

Click the "Apply" button and the Stock you would like to apply for. Read the terms and conditions, complete the application form and place your payment instruction which allows us to debit the subscription amount from your One Account “Deposit" at the specified time stated for individual IPO.

Step 3

Confirm your application details and submit the application. A reference number will be generated for your reference.

Step 4

Make sure your designated account has sufficient fund for settlement at the specified time of individual IPO. Otherwise, your application will be cancelled without further notice.

No, once you have submitted the application and confirmed the details, you cannot amend any application details or cancel your application.

We will send your application to the Share Registrars on or before the IPO official closing time. In case there is any incorrect information or your designated One Account “Deposit” has insufficient fund for settlement, your application will be cancelled without further notice.

For Yellow Form Applicants

The application money (or part thereof) will be credited directly to your One Account “Deposit” on the refund day specified in the respective Prospectus.

For yellow Form Applicants:

If your application is wholly or partially successful, your share certificate(s) will be directly deposited into your One Account "Investment".

Please refer to the details of respective EIPO.

Contact us

- Visit us at a Branch

- Call Us at 2287 6788

Be served by our professional staff at our branches, or opt for self-service banking via our automated channels — the choice is yours.

Careers

We offer a range of rewarding careers from trainee to management level.

Tap into the vast resources and network of our parent bank China CITIC Bank and our ultimate shareholder, CITIC Group Corporation.