Header navigation:

Credit Card Cash-in Installment Program

Easily Cash Out

Tax Payment with One Credit Card

Admin Fee as low as 0.074%

(APR is 1.65%)

Ready to pay taxes? Apply now for Credit Card Cash-in Installment Program and easily convert your available credit limit into cash for tax payment!

Limited Offers:

- Personalized Monthly Administration Fee as low as 0.074% (APR is 1.65)1

- Earn up to HK$11,800 Cash Rebate upon successful drawdown via inMotion2

- Exclusive offers update regularly on inMotion – Login now to discover yours

Product Features:

- No documents required for approval3

- Convert available credit limit to cash

- Fast same-day deposit into your CNCBI account

- Flexible repayment tenor of 12 to 60 months4

- Fixed monthly repayment for better budgeting

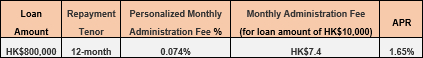

Example:

Remarks

1. The approved amount of HK$800,000, a personalized monthly administration fee of 0.074% and 12-month repayment period calculated, the Annualized Percentage Rate (“APR”) is 1.65%. The examples are for reference only. The APR will be determined based on the customer's credit rating and other relevant loan approval factors, and the bank reserves the final discretion to approve the loan application and to determine the applicable interest rate and handling fee.

The APR is calculated in accordance with the practices and methods set out in the relevant guidelines issued by the Hong Kong Association of Banks. An APR is a reference rate which includes the basic interest rate and other applicable fees and charges expressed as an annualized rate.

The personalized monthly administration fee is applicable to selected customers and is for reference only. The Bank reserves the right at its sole discretion on determining the monthly administration fee from time to time for individual promotion. Please call Credit Card Customer Service Hotline 2280 1288 to check for the personalized monthly administration fee.

2. Customers who apply for and successfully draw down Credit Card “Cash-In Installment Program from 1 January 2026 to 31 March 2026 via inMotion Mobile App with loan amount of HK$30,000 or above and repayment tenor of 24 months or above shall be entitled to up to Hk$11,800 Cash Rebate. For details, please refer to Promotional Terms and Conditions for up to HK$11,800 Cash Rebate.

3. The approval of the Credit Card Cash-in Installment Program is depended on the status of the credit card account. The Bank reserves the right to request Cardmembers to provide supporting document for approval purpose. In addition, if the requested loan amount exceeds the available credit limit, Cardmembers are required to submit income documents. The Bank reserves the right to decide whether to approve or decline any application for Credit Card Cash-in Installment Program.

4. Installment period of 12 months, 24 months, 36 months, 48 months and 60 months are available for selection.

Credit Card “Cash-In Installment Program” – Promotional Terms and Conditions

- Reminder: To borrow or not to borrow?

Borrow only if you can repay!

Ready to Apply?

- Apply online

- Call us at 2280 1288

(press 8 after language selection)

Be served by our professional staff at our branches, or opt for self-service banking via our automated channels — the choice is yours.

- Information Regarding Enhanced Security Measures for Card-Not-Present Credit Card Transactions

- Autopay Application Form

- Check your Card application status

- Key Facts Statement / CNCBI Credit Card Fees and Charges

- Bank Service Fees & Charges

- Addendum To CNCBI Credit Card Cardmember Agreement

- CNCBI Credit Cardmember Agreement

- CNCBI Credit Card(virtual) Credit Cardmember Agreement

- Information regarding making minimum payments & overseas ATM services

- Credit Card Repayment Calculator

- Terms and Conditions for ATM Card

- Disputed Credit Card Transaction Investigation Forms & Guidelines

- Notice of Contactless Payment Function (Visa payWave / Mastercard contactless payment / UnionPay QuickPass)

- Security Tips of Mobile Payment Usage/ Online Transaction

- One Time Password Online Transaction Security Service Frequently Asked Question / Terms and Conditions

Careers

We offer a range of rewarding careers from trainee to management level.

Tap into the vast resources and network of our parent bank China CITIC Bank and our ultimate shareholder, CITIC Group Corporation.